April 24, 2024

| “We now have a Girls Team based in our Los Angeles office whose skill and expertise made it possible for us to bring something really strong to the marketplace.” — Anton Rabie, president and CEO, Spin Master |

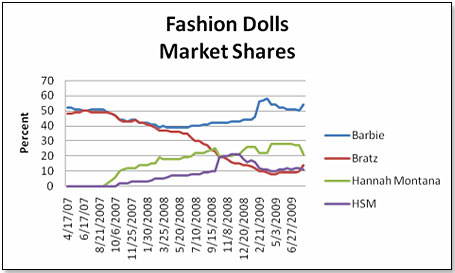

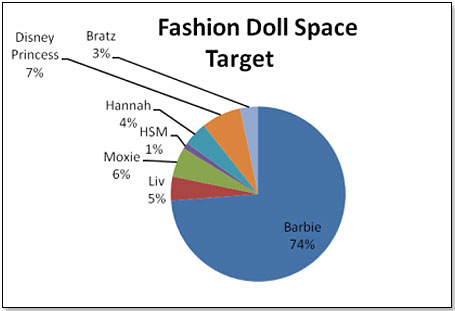

the queen. For a while, it looked as if the brand was succeeding in unseating Barbie, but then Mattel decided to follow the old adage, “If you can’t beat them, go and sue them.” They did, they won, and Bratz is going to become part of the Mattel empire. Undoubtedly, CEO Bob Eckert of Mattel thought for a moment that his problems were over and that Barbie could return to being the comfy money-spinner of old. He was wrong.

the queen. For a while, it looked as if the brand was succeeding in unseating Barbie, but then Mattel decided to follow the old adage, “If you can’t beat them, go and sue them.” They did, they won, and Bratz is going to become part of the Mattel empire. Undoubtedly, CEO Bob Eckert of Mattel thought for a moment that his problems were over and that Barbie could return to being the comfy money-spinner of old. He was wrong.

| Barbie |

50% |

| Bratz |

11% |

| High School Musical | 13% |

| Hannah Montana | 17% |

| Others [Alexander, Fancy Nancy, Ni Hao Kai Lan, Dora, Moxie, Liv, etc.] |

9% |

| Position | Description | Price | Online | On shelf |

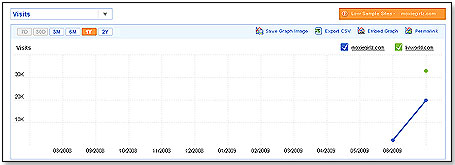

| 1 | Liv Sophie | $19.97 | Yes | No |

| 2 | Liv Katie | $19.97 | Yes | No |

| 3 | Liv Alexis | $19.97 | Yes | No |

| 4 | Liv Daniella | $19.97 | Yes | No |

| 31 | Moxie Best Friends Avery/Lexa |

$24.97 | Yes |

Yes |

| 56 | Moxie Art-Titude Doll Avery |

$19.97 | Yes | No |

| 57 | Moxie Art-Titude Doll Sasha |

$19.97 | Yes | Yes |

| 58 | Moxie Jammaz Doll Sasha |

$16.97 | Yes | Yes |

| 59 | Moxie Magic Hair Sophina |

$29.97 | Yes | No |

| 60 | Moxie Magic Hair Avery |

$29.97 | Yes | No |

| 69 | Moxie Art-Titude Doll Sophina |

$19.97 | Yes | No |

| 73 | Moxie Art-titude Doll Lexa |

$19.97 | Yes | No |

| 75 | Moxie Jammaz Doll Lexa |

$17.97 | Yes | No |

| 76 | Moxie Jammaz Doll Avery |

$17.97 | Yes | No |

| 77 | Moxie Jammaz Doll Sophina |

$17.97 | Yes | No |

I first asked Rabie about a statement made in his company’s press releases that Spin Master is North America’s third-largest toy company. This would put it behind Hasbro and Mattel and in front of Jakks. Rabie said this was based on NPD sell-through data. Assuming these are accurate and there are no major retail inventory variants, this would put Spin Master’s North American business ahead of Jakks’, which last year was in the $650 million range. Spin Master is hence considerably larger than MGA, whose sales in North America are estimated somewhere below $300 million.

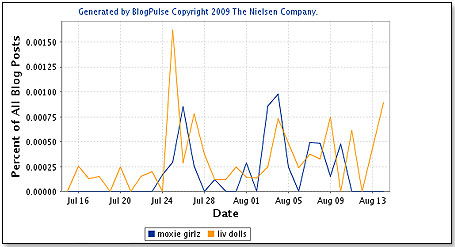

I first asked Rabie about a statement made in his company’s press releases that Spin Master is North America’s third-largest toy company. This would put it behind Hasbro and Mattel and in front of Jakks. Rabie said this was based on NPD sell-through data. Assuming these are accurate and there are no major retail inventory variants, this would put Spin Master’s North American business ahead of Jakks’, which last year was in the $650 million range. Spin Master is hence considerably larger than MGA, whose sales in North America are estimated somewhere below $300 million.  Turning to MGA, sources close to the company were available to provide some color. According to them, Moxie Girlz development began when it became fairly clear that Mattel was going to win the court case against MGA and would hence either walk away with the Bratz brand or make its future commercial use impossible. The brand characteristics of this new doll presented MGA management with a number of difficult choices. They could not just produce a Bratz copy lest Mattel hammer them again, but equally they did not want to lose totally what had made Bratz successful in the first place — giving the consumer a clear and interesting alternative to a very predictable and somewhat dull Barbie.

Turning to MGA, sources close to the company were available to provide some color. According to them, Moxie Girlz development began when it became fairly clear that Mattel was going to win the court case against MGA and would hence either walk away with the Bratz brand or make its future commercial use impossible. The brand characteristics of this new doll presented MGA management with a number of difficult choices. They could not just produce a Bratz copy lest Mattel hammer them again, but equally they did not want to lose totally what had made Bratz successful in the first place — giving the consumer a clear and interesting alternative to a very predictable and somewhat dull Barbie.

Copyright © 2024 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.