April 18, 2024

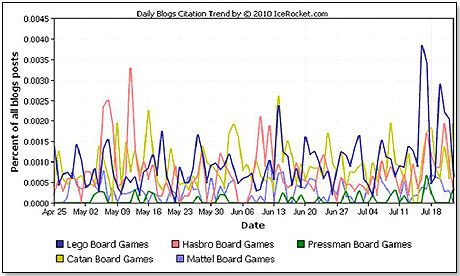

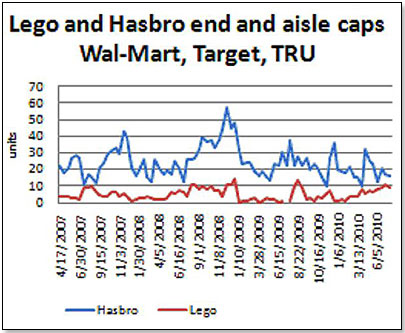

| “Lego has already set the stage for its board game rollout by pre-empting end caps and aisle caps at the large U.S. retailers.” |

There are, today, 25 versions of Monopoly on the shelves (from Hasbro) — nearly half of them hooked up with licenses such as SpongeBob, Littlest Pet Shop, Transformers, Disney Princess and Star Wars. In addition, there are 17 electronic versions.

There are, today, 25 versions of Monopoly on the shelves (from Hasbro) — nearly half of them hooked up with licenses such as SpongeBob, Littlest Pet Shop, Transformers, Disney Princess and Star Wars. In addition, there are 17 electronic versions.| Category | Dominant Players |

2003 |

2004 |

2005 |

2006 | 2007 | 2008 | 2009 | 2010* | 2003- 2010** |

| Action Figures |

Hasbro |

1300 |

1300 |

1500 |

1400 | 1500 | 1500 | 1600 | 1450 | +12.63% |

| Building Sets |

LEGO |

581.8 | 604.9 |

695.8 |

684.8 | 699.5 | 878.5 | 1100 | 1200 | +43.97% |

| Infant/ Preschool |

Mattel |

3100 |

3100 |

3300 |

3400 | 3200 | 3000 | 3000 | 3000 | +1.38% |

| Games/ Puzzles |

Hasbro | 2700 | 2700 |

2500 |

2400 | 2300 | 2300 | 2400 | 2350 | -10.32% |

| Total Toys |

22900 | 22900 | 22700 |

22700 | 22300 | 21600 | 21500 |

22000 | -2.88% |

LEGO GAME SALES TAKE OFF

LEGO GAME SALES TAKE OFF| Manufacturer | U.S. Market Share: Games and Puzzles Category (all channels) |

U.S. Market Share: Games and Puzzles Category (online only) |

Main Product |

Comment |

| Hasbro | 60% | 45.1% | Monopoly |

|

| Mattel | 15% | 7.5% | Apples to Apples | |

| Lego | 2% | 12.4% | Minotaurus | appeared on shelves early July |

| Cardinal Games | 8% | 0% | None | mainly private label |

| Pressman | 7% | 5% | Rummikub | |

| Catan | 3% | 3.6% | Settlers of Catan | |

| Others | 6% | 26.4% |

| Demographic | Lego % |

Hasbro % | Pressman % | Catan % | Mattel % |

| Female | 51 | 54 | 64 | 51 | 49 |

| Male | 49 | 46 | 36 | 49 | 57 |

| 3 - 12 years | 20 | 17 | 10 | 9 | 9 |

| 13 -17 years | 30 | 21 | 8 | 16 | 3 |

| 18 - 34 years | 18 | 25 | 8 | 16 | 3 |

| 35 - 49 years | 24 | 27 | 30 | 27 | 37 |

| 50+ years | 8 | 18 | 31 | 10 | 13 |

| Caucasian | 79 | 81 | 86 | 82 | 87 |

| African-American | 4 | 6 | 7 | 7 | 5 |

| Asian | 6 | 3 | 2 | 3 | 5 |

| Hispanic | 10 | 9 | 4 | 6 | 2 |

| Other | 1 | 1 | 1 | 2 | 1 |

| No children | 27 | 31 | 62 | 54 | 40 |

| Children 0 - 17 years | 73 | 69 | 38 | 46 | 60 |

| Income $0 - $30K | 11 | 13 | 22 | 27 | 13 |

| Income $30K - $60K | 25 | 27 | 35 | 31 | 28 |

| Income $60K - $100K | 34 | 32 | 27 | 21 | 22 |

| Income $100K + | 29 | 29 | 16 | 22 | 24 |

| No college | 43 | 46 | 48 | 35 | 37 |

| College | 42 | 41 | 38 | 48 | 48 |

| Graduate school | 15 | 13 | 1 | 17 | 15 |

LEGO Games: Creationary by LEGO Roll the LEGO® Dice to select one of four exciting building categories (vehicles, buildings, nature or things) in this interactive game for three to eight players. With three levels of difficulty, this game allows families and friends to test their imagination, creativity, building and guessing skills. Game includes one buildable LEGO Dice, one LEGO minifigure, one LEGO microfigure, 96 cards, 1 rule booklet and 341 building pieces. Launch date: 2010. 4/5/2010 (MSRP: $34.99; Age: 7 and Up)

Roll the LEGO® Dice to select one of four exciting building categories (vehicles, buildings, nature or things) in this interactive game for three to eight players. With three levels of difficulty, this game allows families and friends to test their imagination, creativity, building and guessing skills. Game includes one buildable LEGO Dice, one LEGO minifigure, one LEGO microfigure, 96 cards, 1 rule booklet and 341 building pieces. Launch date: 2010. 4/5/2010 (MSRP: $34.99; Age: 7 and Up)

Monopoly U-Build by HASBRO INC. As part of the brand's 75th anniversary celebration, Monopoly is giving players the chance to choose how long they want to enjoy a game with Monopoly U-Build, a new concept in Monopoly game play. Using hexagonal property spaces that snap together, players build a game track that creates a custom game board and determines the length of play. Decide to use the Starter Track for a 30-minute game before dinner, or try the Classic Track for a 60-minute game during family game night for longer-lasting fun. Once you've perfected these tracks, move onto the Pro or Freestyle Tracks for the ultimate gaming challenge. For two to six players. Launch date: Spring 2010. 4/30/2010 (MSRP: $9.99; Age: 8 and Up)

As part of the brand's 75th anniversary celebration, Monopoly is giving players the chance to choose how long they want to enjoy a game with Monopoly U-Build, a new concept in Monopoly game play. Using hexagonal property spaces that snap together, players build a game track that creates a custom game board and determines the length of play. Decide to use the Starter Track for a 30-minute game before dinner, or try the Classic Track for a 60-minute game during family game night for longer-lasting fun. Once you've perfected these tracks, move onto the Pro or Freestyle Tracks for the ultimate gaming challenge. For two to six players. Launch date: Spring 2010. 4/30/2010 (MSRP: $9.99; Age: 8 and Up)

LEGO Games: Ramses Pyramid by LEGO LEGO Games has developed the first collection of buildable games with changeable rules and a unique buildable LEGO Dice. In this game, the Mummy King Ramses is planning on conquering all of Egypt with his army of mummies. Players must unlock the crystal coded layers to climb to the top of the pyramid and defeat the Mummy King in this family game of memory, skill and cunning. An entertaining game for 2 to 4 who can play as a team or opponents. Includes: 1 buildable LEGO Dice, 13 LEGO microfigures, 1 rule booklet, 1 building instruction. Launch date: 2010. 3/19/2010 (Age: 8 and Up)

LEGO Games has developed the first collection of buildable games with changeable rules and a unique buildable LEGO Dice. In this game, the Mummy King Ramses is planning on conquering all of Egypt with his army of mummies. Players must unlock the crystal coded layers to climb to the top of the pyramid and defeat the Mummy King in this family game of memory, skill and cunning. An entertaining game for 2 to 4 who can play as a team or opponents. Includes: 1 buildable LEGO Dice, 13 LEGO microfigures, 1 rule booklet, 1 building instruction. Launch date: 2010. 3/19/2010 (Age: 8 and Up)

Minotaurus by LEGO The mythical Minotaur protects a secret temple hidden deep inside a labyrinth and players must be the first to lead their three heroes to the temple, avoiding the Minotaur and cleverly placing walls to block their opponents. By changing the LEGO dice, players can jump hedges, and by re-building the maze, every game is a new adventure. For 2 to 4 players, the game includes 1 buildable LEGO® Dice, 12 LEGO microfigures, 1 building instruction booklet, and 1 rule booklet. Awards: Parent's Choice Award 2010

The mythical Minotaur protects a secret temple hidden deep inside a labyrinth and players must be the first to lead their three heroes to the temple, avoiding the Minotaur and cleverly placing walls to block their opponents. By changing the LEGO dice, players can jump hedges, and by re-building the maze, every game is a new adventure. For 2 to 4 players, the game includes 1 buildable LEGO® Dice, 12 LEGO microfigures, 1 building instruction booklet, and 1 rule booklet. Awards: Parent's Choice Award 2010

— As of 8.03.2010, this product had 4.5 out of 5 stars from 14 reviews on Amazon.com and was No. 19 in the top 100 best-selling toys and games. PROS: Children enjoy playing, and it holds their interest. CONS: Small parts can be a choking hazard, and are difficult to manipulate on the board.

Awards: Dr. Toy 100 Best Children's Products - 2010 (![]() Watch Video) 3/17/2010 (MSRP: $24.99; Age: 7 to 12)

Watch Video) 3/17/2010 (MSRP: $24.99; Age: 7 to 12)

Monopoly: Revolution Edition by HASBRO INC. HASBRO hopes to start a revolution with its new Monopoly: Revolution Edition. The centerpiece of the game is its round board, which retains the original Atlantic City properties. An electronic system keeps track of all the money, so no arguments are necessary. The electronic system also acts as die and plays clips from hit songs for some in-game entertainment. Launch date: Fall 2010. 2/16/2010 (MSRP: $34.99; Age: 8 and Up)

HASBRO hopes to start a revolution with its new Monopoly: Revolution Edition. The centerpiece of the game is its round board, which retains the original Atlantic City properties. An electronic system keeps track of all the money, so no arguments are necessary. The electronic system also acts as die and plays clips from hit songs for some in-game entertainment. Launch date: Fall 2010. 2/16/2010 (MSRP: $34.99; Age: 8 and Up)

The Settlers of Catan® (4th Edition) by MAYFAIR GAMES INC. In this game designed by Klaus Teber, three to four players who are immigrants to Catan must develop their colony on the island by establishing roads, villages and settlements and making strategic trades of bricks and lumber, livestock or other commodities to obtain necessary resources. Play takes about 60 to 90 minutes. The first player to 10 points wins. "The new edition was released three years ago and has sold more copies in those three years than the first, second or third editions combined," Bob Carty, Sales & Marketing Director, Mayfair Games, told TDmonthly in early 2010.

In this game designed by Klaus Teber, three to four players who are immigrants to Catan must develop their colony on the island by establishing roads, villages and settlements and making strategic trades of bricks and lumber, livestock or other commodities to obtain necessary resources. Play takes about 60 to 90 minutes. The first player to 10 points wins. "The new edition was released three years ago and has sold more copies in those three years than the first, second or third editions combined," Bob Carty, Sales & Marketing Director, Mayfair Games, told TDmonthly in early 2010.

— In August 2010, five percent of 43 retailers surveyed named The Settlers of Catan an overall top seller. The same month, Steven Levy, owner of Toy City in Keene, New Hampshire, told TDmonthly his store sells approximately three Settlers of Catan games per week.

— “It's real easy to teach, and then you just develop strategies from there," Mike Snyder, owner and manager of Cville's Hobbies, Games and Toys in Charlottesville, Va., told TDmonthly in a February 2012 survey about best selling games. Cville's sells 16-20 copies of the game each month.

— As of 12/17/2012 this product had 4.7 out of 5 stars from 632 reviews on Amazon.com. 3/3/2010 (MSRP: $42.00; Age: 10 and Up)

Blokus by MATTEL INC. Europe´s 2002 game of the year, Blokus is a strategy game for the family. It's similar to the ancient Go Game — the board is a grid and players use their pieces to try to control as much territory as possible. The game pieces are in four, 21-piece sets of varying shapes. Each player chooses a color and works on expanding his territory on the board while blocking others from doing the same. Each new piece laid down must touch at least one other piece of the same color, but can only touch at corners, not along edges. The game ends when all players have been blocked from laying down more pieces. Points are deducted for pieces not played, and the player with the highest score at the end, wins. Blokus comes with a game board with 400 squares, 84 game pieces (red, green, blue and yellow), and instructions.

Europe´s 2002 game of the year, Blokus is a strategy game for the family. It's similar to the ancient Go Game — the board is a grid and players use their pieces to try to control as much territory as possible. The game pieces are in four, 21-piece sets of varying shapes. Each player chooses a color and works on expanding his territory on the board while blocking others from doing the same. Each new piece laid down must touch at least one other piece of the same color, but can only touch at corners, not along edges. The game ends when all players have been blocked from laying down more pieces. Points are deducted for pieces not played, and the player with the highest score at the end, wins. Blokus comes with a game board with 400 squares, 84 game pieces (red, green, blue and yellow), and instructions.

— In spring 2007, Sally Lesser, owner of Massachusetts’ Henry Bear’s Park, called Blokus a “consistent best-seller” at her three stores. It's also tops at Juggles in Wakefield, R.I., and Kazoodles in Vancouver, Wash. Six of 63 retailers named Blokus as their overall best seller in September 2008. Three of 52 retailers named Blokus as one of their overall top sellers in November 2008. Blokus is no longer distributed by Educational Insights as of 12/4/08.

― “No. 1 is Blokus,” Linda Hanzelko, owner of Timmy's Toy Chest in Lake Mary, Fla., told TDmonthly when asked about best-selling games in early 2009. “It's an easy sell. It's one that people come back later and say 'You were right.'” In late 2009, Lori Hershman, owner of Evan's Toy Shoppe in Hamden, Ct., estimated sales of about 34 units monthly. Six of 38 retailers called it a best-selling game in Feb. 2010, selling from three to 150 units per month. 5/27/2005 (MSRP: $29.99; Age: 5 to 12)

Stratego by HASBRO INC. Stratego is a classic game of battlefield strategy. Players use memory, cunning and luck to capture the enemy's flag. The game accommodates two to four players. Launch date: November 30, 1998.

Stratego is a classic game of battlefield strategy. Players use memory, cunning and luck to capture the enemy's flag. The game accommodates two to four players. Launch date: November 30, 1998.

— “This is bizarre: I have never in years gotten a call for the game Stratego, but this year I got tons of them,” said Kevin Tjaden, owner for 25 years of Scientific Wizardry in Boise, Idaho. “We're trying to figure out why. I don't know if it was in a movie. Rubik's Cube we did carry, and that was in the movie with Will Smith.”

— Movie or no, Stratego continues to be a best seller.

— It ranked No. 15 for strategy games on Amazon.com as of December 28, 2006. 12/28/2006 (MSRP: $15.99; Age: 8 and Up)

Cranium - Family Edition by HASBRO INC. Just as fun for adults as it is for kids, Cranium Family Edition features activities that challenge adults, too. From balancing cubes on elbows to deciding what the most popular pet was in ancient Egypt, kids and parents alike will celebrate the wacky collaboration that results from the outrageous activities teams are asked to complete. To play, teams work together to race around the board by completing a mix of classic and all-new CRANIUM activities, including sketching, acting, solving word and picture puzzles, completing scavenger hunts, sculpting with purple Cranium Clay and more. The Data Head in your family will love guessing how many NFL teams are named after birds and trying to remember the first five gifts in “The Twelve Days of Christmas,” while the Creative Cat will enjoy sculpting a turtle out of Cranium Clay or attempting to draw a palm tree with their eyes closed. Launch: 2008. 9/25/2008 (MSRP: $19.99; Age: 8 and Up)

Just as fun for adults as it is for kids, Cranium Family Edition features activities that challenge adults, too. From balancing cubes on elbows to deciding what the most popular pet was in ancient Egypt, kids and parents alike will celebrate the wacky collaboration that results from the outrageous activities teams are asked to complete. To play, teams work together to race around the board by completing a mix of classic and all-new CRANIUM activities, including sketching, acting, solving word and picture puzzles, completing scavenger hunts, sculpting with purple Cranium Clay and more. The Data Head in your family will love guessing how many NFL teams are named after birds and trying to remember the first five gifts in “The Twelve Days of Christmas,” while the Creative Cat will enjoy sculpting a turtle out of Cranium Clay or attempting to draw a palm tree with their eyes closed. Launch: 2008. 9/25/2008 (MSRP: $19.99; Age: 8 and Up)

MONOPOLY® Disney-Pixar Edition by HASBRO INC. In this variation of the classic Monopoly game, two to six players can collect the following Disney-Pixar-themed tokens: Buzz Lightyear, Sulley and Boo, Nemo, Mr. Incredible, Lightning McQueen and Remy. Launch date: September 2007. 10/17/2007 (MSRP: $21.99; Age: 8 and Up)

In this variation of the classic Monopoly game, two to six players can collect the following Disney-Pixar-themed tokens: Buzz Lightyear, Sulley and Boo, Nemo, Mr. Incredible, Lightning McQueen and Remy. Launch date: September 2007. 10/17/2007 (MSRP: $21.99; Age: 8 and Up)

Copyright © 2024 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.