April 19, 2024

August 2011 | Vol. X - No. 8

U.S. Toy Market Outlook 2011

Why the U.S Toy Industry has Nothing to Smile About

The two weeks leading up to Easter this year had been better for toys than the national buyers had expected and this led them to believe that this was a harbinger of things to come.

The two weeks leading up to Easter this year had been better for toys than the national buyers had expected and this led them to believe that this was a harbinger of things to come.

This was also about the time when buyers were finalizing their toy sales forecasts for the second half of this year, which they use as a basis for putting together their Purchase Orders for shipments from late August through the end of November.

Since then, toy sales have gone one way only – down. Not so surprisingly, the buyers ratcheted their sales expectation for the second half down as well – from a plus 2% at the end of April, to a flat by end of June, to a minus 2% now.

They have not yet cut back on their Purchase Orders but they are likely to when it comes to issuing the remainder of them in August. And, if worst comes to worst, they are not beyond canceling existing orders.

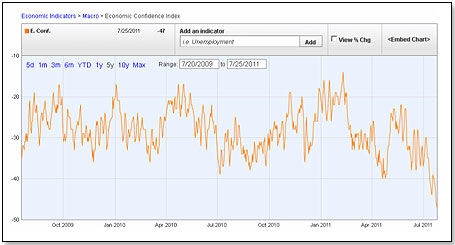

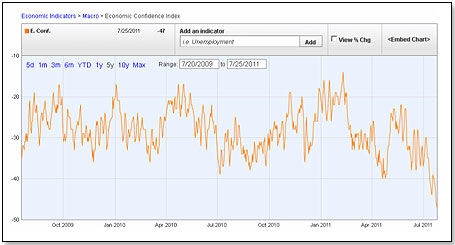

One of the reasons for this downturn is that the U.S. consumer has not been a happy camper. This is what the Gallup 3 day rolling average of U.S. economic confidence index graph tells us, from the consumers’ perspective:

While consumer confidence plummeted and purchase orders are likely to be cut, manufacturing costs for the Chinese toy manufacturers continued to skyrocket in the face of declining output because of lower than expected orders. The Chinese economy has been overheating and inflation is becoming a problem. As a result, wages and other costs go up. While all large toy companies [except for Lego] rely to a larger or lesser degree on Chinese manufacturers to produce the bulk of their orders, and while these same manufacturers have signed ironclad contracts guaranteeing the prices at which they sell to the Hasbros and Mattels of this world, these contracts are now just so much paper in the face of what more and more looks like a perfect storm.

The cost increases facing these manufacturers are such that they have two choices – get price increases or go out of business. The shutdown of the South Korean-owned Dongguan Soyea Toys in mid-July, one of the oldest toy factories in Dongguan, is a case in point. Soyea had been operating since 1992 and was a supplier to major American retailers. The company went bankrupt, however, as export orders fell amid rising costs. Li & Fung, the world's biggest supplier of toys to retailers including Wal-Mart and Target, and who manufactures about half of its products in China, says that they will not mess about. They will pass on any cost increases to their customers or they will not ship.

The cost increases facing these manufacturers are such that they have two choices – get price increases or go out of business. The shutdown of the South Korean-owned Dongguan Soyea Toys in mid-July, one of the oldest toy factories in Dongguan, is a case in point. Soyea had been operating since 1992 and was a supplier to major American retailers. The company went bankrupt, however, as export orders fell amid rising costs. Li & Fung, the world's biggest supplier of toys to retailers including Wal-Mart and Target, and who manufactures about half of its products in China, says that they will not mess about. They will pass on any cost increases to their customers or they will not ship.

What are these cost increases? I talked to a number of my Chinese friends who between them pretty much agreed on the extent of the problem. Their costs, including the foreign exchange factor, are expected to go up by about 20% this year which, given their normal net margin of about 5%, they simply cannot absorb. This is how their numbers broke out:

| Cost Component |

% of Cost 12/2010 |

Cost Increase % |

% of Cost 12/2011 |

| Freight/Logistics |

11.80 |

0.00 |

11.80 |

| Labor |

20.95 |

50.00 |

31.45 |

| Resins |

13.25 |

20.00 |

15.90 |

| Power |

7.70 |

20.00 |

9.24 |

| Packaging |

18.75 |

25.00 |

23.44 |

| Other Direct Costs |

16.55 |

10.00 |

18.21 |

| Factory Overhead |

11.00 |

5.00 |

5.55 |

| Total COGS |

100.00 |

15.60 |

115.59 |

| Foreign Exchange |

100.00 |

5.00 |

5.00 |

| Total |

100.00 |

20.59 |

120.59 |

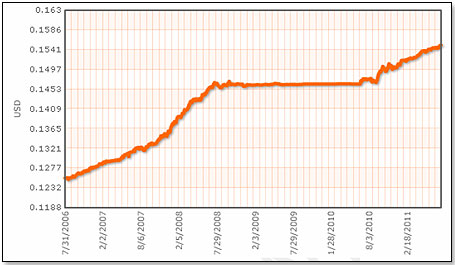

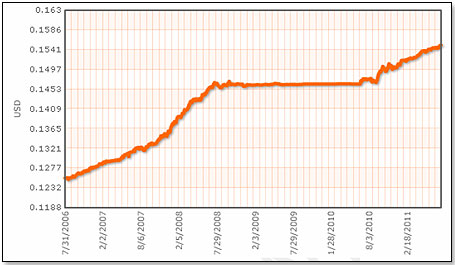

The last item in the table above merits some more comment. The Renminbi has for years been pegged against the U.S. Dollar at an extraordinarily low level which basically subsidizes Chinese exports and hence benefits American consumers. However, there has been extraordinary pressure from the side of Congress on the Chinese to revalue their currency, and the Chinese have slowly and in a very measured manner let the Renminbi rise against the Dollar:

This is expected to continue. However, should inflation in China continue to accelerate, then the Bejing authorities may have no alternative to let the currency float freely and find its own level. This is generally assumed to be unlikely but were it to happen, the effect on the pricing of Chinese exports would be very significant.

Even assuming that this extreme situation will not occur, we will still without doubt have a situation where Chinese costs will go up by about 20% this year, and these Chinese manufacturers will equally without a doubt pass these costs on to the American importers. In other words, if the U.S. toy manufacturers want to get the goods they need, they will have to pay more for them. But that should be no problem, right? Their costs go up so they increase their prices to the long suffering American consumer, right?

Even assuming that this extreme situation will not occur, we will still without doubt have a situation where Chinese costs will go up by about 20% this year, and these Chinese manufacturers will equally without a doubt pass these costs on to the American importers. In other words, if the U.S. toy manufacturers want to get the goods they need, they will have to pay more for them. But that should be no problem, right? Their costs go up so they increase their prices to the long suffering American consumer, right?

Not so fast.

The major toy manufacturers took price increases earlier this year to reflect their cost increases up to that point. Some of them went back to the national buyers again a couple of weeks ago to discuss more price increases later this year to offset the higher prices they will have to pay to their Chinese vendors on upcoming shipments. The buyers I spoke to told me that they had had only one answer – NO! They thought that price increases in September or October were a terrible idea and likely to spook the consumer even further. They agreed that they could not stop these companies from unilaterally hiking their prices if they really wanted to do so but they, the buyers, would then reduce Purchase Orders quantities to reflect that new pricing reality. Unsurprisingly, both Mattel and Hasbro said recently that they would not increase prices this year for a second time.

So, costs you cannot pass on is one part of the equation. The other part is the quantities you can expect to sell. And there again is a problem.

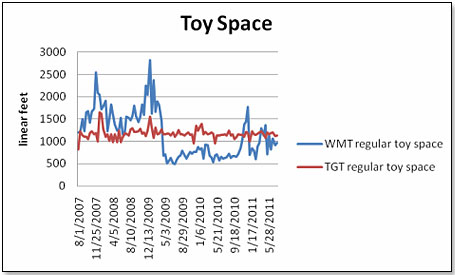

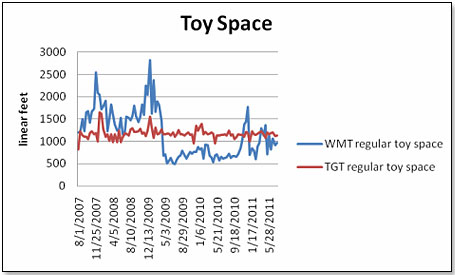

Last year, the toy manufacturers were rescued by a sharp expansion of toy shelf space by both Wal-Mart and Toys”R”Us. In the case of the latter, this increase came in the form of 600 small pop-up stores – 2500 squarefeet each – which effectively increased their overall toy space by about one quarter. Wal-Mart, not to be outdone, decided to double up their shelf space for fourth quarter whereas Target decided to continue keeping to its old model. Their shelf space in linear footage for toys developed as follows:

As you can see, Wal-Mart never got back the toy space it lost in the context of Project Impact in 2009, and it is now significantly below the levels they had in the fourth quarter last year. It is my understanding that this sharp increase in shelf space that occured last year, and which was basically a failure, will not be repeated this year.

While I would expect Toys”R”Us to repeat its pop-up stores effort this year, there is another move in the making which is going to be a nasty surprise to most toy manufacturers. Toys”R”Us is beginning to rejig their regular store layout – now comprising about 10% video games, 20% Babies”R”Us products and 70% toys – to one which will give much more shelf space to the BRU products. In fact, I am told that they are going to progressively change to a shelf allocation which keeps the 10% video game space but expands BRU to 45% and reduces toys also to 45%. From Toys”R”Us perspective, this makes eminent sense. Toys are an incredibly competitive category whereas products for babies have much more price elasticity.

In the case of Target, it is my understanding that there are conversations ongoing to the effect that more toy sales should be shifted to the web, which would free brick-and-mortar space for more lucrative endeavors. This is logical from their perspective. Toys have essentially been flat in Dollar terms for the last ten years whereas other categories – consumer electronics, fresh food, et. – have not only grown measurably, but are also more profitable. And, of course, Amazon has shown that you can indeed sell toys on the web. However, this is terrible news for toy manufacturers.

In the case of Target, it is my understanding that there are conversations ongoing to the effect that more toy sales should be shifted to the web, which would free brick-and-mortar space for more lucrative endeavors. This is logical from their perspective. Toys have essentially been flat in Dollar terms for the last ten years whereas other categories – consumer electronics, fresh food, et. – have not only grown measurably, but are also more profitable. And, of course, Amazon has shown that you can indeed sell toys on the web. However, this is terrible news for toy manufacturers.

Wal-Mart doubling up their toy space last year rescued a number of manufacturers from a pretty miserable year, in that these additional shelves needed to be stocked with products, and the warehouses had to have backup inventory. This was “Manna from heaven” for them, but they had to pay the piper in the first quarter this year, since most of the stuff that was shipped sat on the same shelves and in the same warehouses at the end of 2010. They will not have the same problem this year, but they will also not have the bulge of shipments which this change by Wal-Mart brought about.

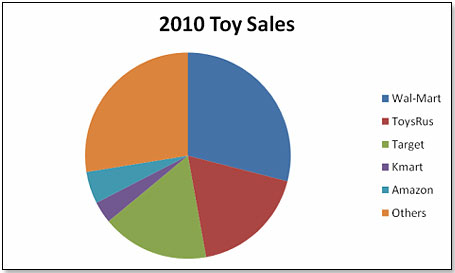

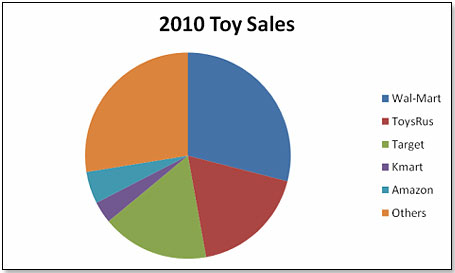

While the Wal-Mart adventure was a one-time thing, the changes ongoing at Toys”R”Us and contemplated at Target are much more serious and severe. This is best demonstrated by looking at the market shares the vaious retailers have now in the toy space:

In other words, the toy space catering to two-thirds of the U.S. toy market is now in play.

So, to summarize, this is what the U.S. toy manufacturers are facing this year:

- Cost Increases which they cannot pass on to the consumer

- Flat or even reduced toy purchases by the consumers which will affect shipments

- Reduced toy space offered by the major retailers which will eat into the manufacturers’ sales.

As I said, nothing to smile about!

Copyright © 2024 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.

The two weeks leading up to Easter this year had been better for toys than the national buyers had expected and this led them to believe that this was a harbinger of things to come.

The two weeks leading up to Easter this year had been better for toys than the national buyers had expected and this led them to believe that this was a harbinger of things to come.

The cost increases facing these manufacturers are such that they have two choices – get price increases or go out of business. The shutdown of the South Korean-owned Dongguan Soyea Toys in mid-July, one of the oldest toy factories in Dongguan, is a case in point. Soyea had been operating since 1992 and was a supplier to major American retailers. The company went bankrupt, however, as export orders fell amid rising costs. Li & Fung, the world's biggest supplier of toys to retailers including Wal-Mart and Target, and who manufactures about half of its products in China, says that they will not mess about. They will pass on any cost increases to their customers or they will not ship.

The cost increases facing these manufacturers are such that they have two choices – get price increases or go out of business. The shutdown of the South Korean-owned Dongguan Soyea Toys in mid-July, one of the oldest toy factories in Dongguan, is a case in point. Soyea had been operating since 1992 and was a supplier to major American retailers. The company went bankrupt, however, as export orders fell amid rising costs. Li & Fung, the world's biggest supplier of toys to retailers including Wal-Mart and Target, and who manufactures about half of its products in China, says that they will not mess about. They will pass on any cost increases to their customers or they will not ship.

Even assuming that this extreme situation will not occur, we will still without doubt have a situation where Chinese costs will go up by about 20% this year, and these Chinese manufacturers will equally without a doubt pass these costs on to the American importers. In other words, if the U.S. toy manufacturers want to get the goods they need, they will have to pay more for them. But that should be no problem, right? Their costs go up so they increase their prices to the long suffering American consumer, right?

Even assuming that this extreme situation will not occur, we will still without doubt have a situation where Chinese costs will go up by about 20% this year, and these Chinese manufacturers will equally without a doubt pass these costs on to the American importers. In other words, if the U.S. toy manufacturers want to get the goods they need, they will have to pay more for them. But that should be no problem, right? Their costs go up so they increase their prices to the long suffering American consumer, right?

In the case of Target, it is my understanding that there are conversations ongoing to the effect that more toy sales should be shifted to the web, which would free brick-and-mortar space for more lucrative endeavors. This is logical from their perspective. Toys have essentially been flat in Dollar terms for the last ten years whereas other categories – consumer electronics, fresh food, et. – have not only grown measurably, but are also more profitable. And, of course, Amazon has shown that you can indeed sell toys on the web. However, this is terrible news for toy manufacturers.

In the case of Target, it is my understanding that there are conversations ongoing to the effect that more toy sales should be shifted to the web, which would free brick-and-mortar space for more lucrative endeavors. This is logical from their perspective. Toys have essentially been flat in Dollar terms for the last ten years whereas other categories – consumer electronics, fresh food, et. – have not only grown measurably, but are also more profitable. And, of course, Amazon has shown that you can indeed sell toys on the web. However, this is terrible news for toy manufacturers.