U.S. Department of Commerce Industry Report

Dolls, Toys, Games, and Children's Vehicles NAICS Code 33993

Industry Definition

NAICS 339931 comprises establishments primarily engaged in manufacturing complete dolls,

doll parts, and doll clothes, action figures, and stuffed toys. NAICS 339932 comprises

establishments primarily engaged in manufacturing games and game sets for adults and

children, and mechanical and non-mechanical toys. Establishments primarily engaged in

manufacturing electronic video game cartridges and non-doll rubber toys are not included. The

information in this industry report aggregates the industry data for both NAICS codes.

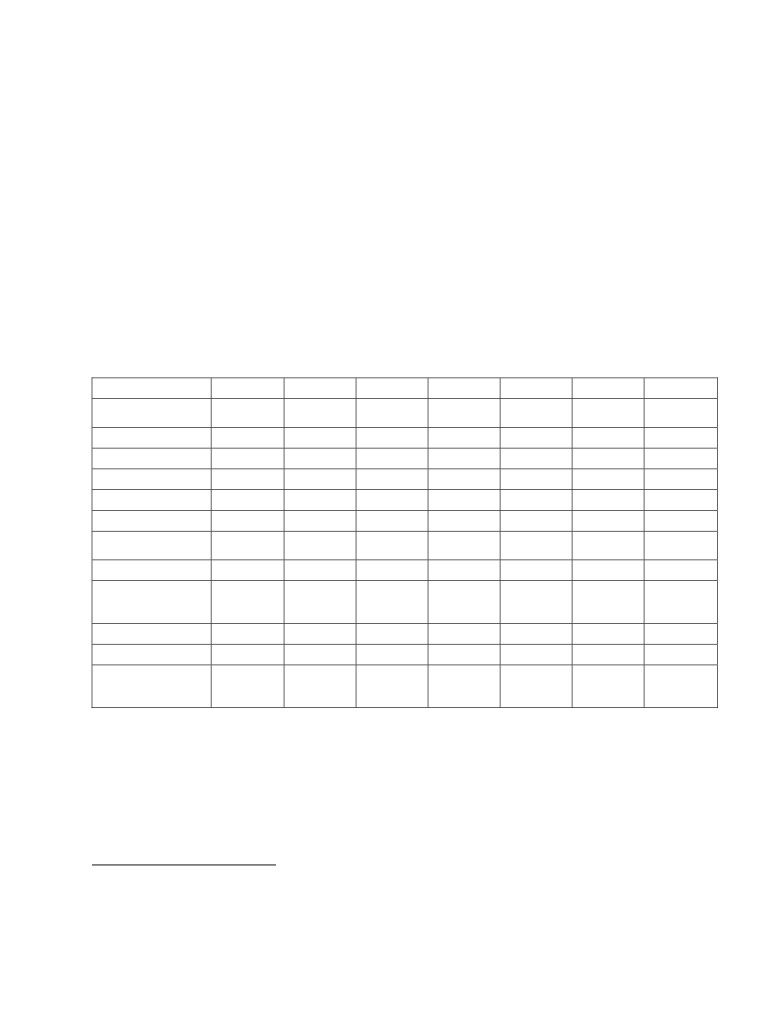

Current Economic Indicators NAICS 33993

See the table below for a complete listing of the current economic indicators for the toy

industry1.

2004

2005

2006

2007

2008

2009

2010

Total Value of

Shipments

$3,558,885

$3,721,741

$3,904,760

$3,021,754

$2,861,473

$2,115,219

$2,307,707

Product Shipments

$3,180,434

$3,284,022

$3,431,119

$2,526,067

$2,568,226

$1,882,415

$2,076,556

$880,493

$1,070,187

$1,325,192

$1,983,033

$1,554,128

$1,582,753

$1,531,789

Exports

$14,244,081

$16,243,647

$16,971,999

$21,768,888

$22,820,281

$20,423,985

$21,427,885

Imports

Apparent

Consumption

$16,922,473

$18,895,201

$19,551,567

$22,807,609

$24,127,626

$20,956,451

$22,203,803

Imports as a % of

Apparent

Consumption

84.17%

85.97%

86.81%

95.45%

94.58%

97.46%

96.51%

$12,053,678

$13,439,770

$14,592,830

$19,446,731

$20,677,929

$18,330,413

$18,979,444

Imports from China

Imports from China

as a % of Apparent

Consumption

71.23%

71.13%

74.64%

85.26%

85.70%

87.47%

85.48%

The industry's domestic production in 2010, the latest year of available data, was estimated at

approximately $2.076 billion. While the majority of toys destined for the American market are

designed in the United States, large-scale production has shifted abroad. However, even

though large portions of the major U.S. toy companies' product lines are manufactured outside

the United States, they still incorporate significant U.S. value in terms of the product design,

marketing, research and development, and corporate support functions. While U.S. toy

1 This report uses the most recent full year data, 2010. Sources: U.S. Census Bureau's Annual Survey of

companies have their own toy development divisions, they also support a network of

independent toy inventors and designers that sell their concepts to the larger companies. The

largest U.S. toy trade association, Toy Industry Association (TIA) has resources that toy

inventors and designers can use to market their products to manufacturers. TIA organizes one

of the world's largest toy trade shows. Held each year in February in New York City, Toy Fair

attracts more than 20,000 attendees and 12,000 exhibitors in 350,000 square feet of exhibit

space.

TIA estimates domestic toy related employment at 31,000. TIA member companies employed

approximately 26,215 U.S. workers in 2009. TIA employment figures capture all toy related

operations including independent toy inventors and designers. The Bureau of Labor Statistics'

Quarterly Assessment of Employment and Wages estimated 2010 employment at 11,886, down

from 12,881 in 2010.2 The Census Bureau's 2010 Annual Survey of Manufactures (ASM)3, a

sampling of manufacturing operations, estimated manufacturing related employment at 9,137.

Toy Sales

The U.S. Toy Industry Association, TIA, estimates that U.S. retail sales of traditional toys were

$21.78 billion in 2008, up 2 percent from 20094. TIA member companies reported that the toy

categories of Dolls, Building Sets and Outdoor & Sports toys saw the strongest growth in 2010,

while Youth Electronics, Action Figures & Accessories, and Games & Puzzles saw the largest

drop.

TIA estimates that the worldwide retail sales of toys totaled $80.280 billion in 20095. The top

ten markets by retail sales were: United States; Japan, China, the United Kingdom, France,

Germany, Brazil, India, Australia, and Canada. Annual toy spending per child in these markets

ranged from a high of $401 in Australia to a low of $6 in India.6

2 https://www.bls.gov/cew. Major exclusions include self-employed workers.

survey of approximately 50,000 establishments.

4 The term "traditional toys'' does not include video games. TIA's "State of the Industry Table available at:

81a73a-ce46-4caf-8bc1-72b99567df1e#.UXGj0qw8_ng

5 TIA commissioned report "Toy Markets in the World: Summary Charts Annual 2009'' by the NPD Group available

6 Ibid.

U.S. Exports and Imports of NAICS 33993

U.S. trade statistics don't reflect the global strength of the U.S. toy industry since the majority of toys

consumed in the U.S. are imported or produced regionally to serve specific markets. The U.S. toy

industry exported $1.531 billion in 2010 a decrease of 3.2 percent from 2009.

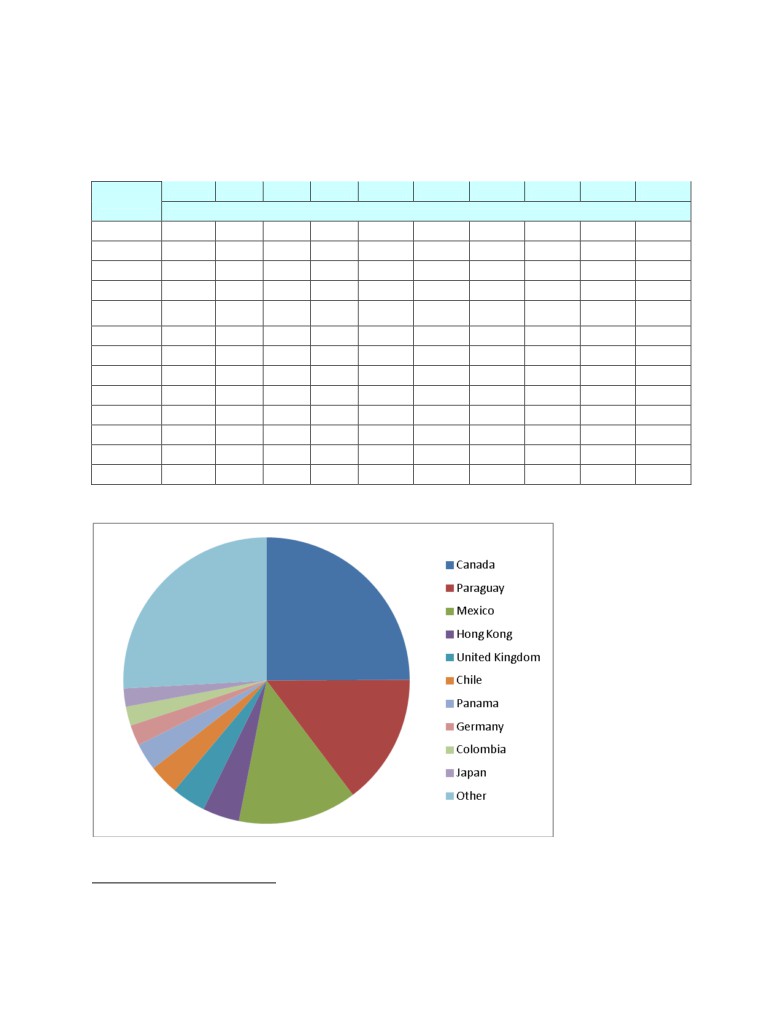

Toys, Dolls, and Games NAICS 33993: FAS Value U.S. Domestic Exports7

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Country

In 1,000 Dollars

Canada

293,472

319,731

337,921

315,458

443,826

433,283

540,887

376,955

367,525

381,652

Paraguay

12,490

15,478

34,803

26,176

16,306

34,424

37,183

99,898

163,015

226,508

Mexico

128,249

88,520

68,873

81,188

78,699

233,321

749,717

324,323

229,555

205,271

Hong Kong

29,343

44,627

52,523

46,902

54,559

71,809

106,324

69,043

82,470

63,552

United

70,613

68,025

65,745

71,811

75,387

76,536

72,676

74,359

71,177

59,067

Kingdom

Chile

6,915

5,451

6,752

5,669

30,618

36,085

31,501

47,421

39,452

52,227

Panama

5,138

5,852

5,403

5,757

8,696

11,982

24,188

55,816

49,508

46,806

Germany

20,244

21,728

16,246

20,436

16,692

16,816

17,544

15,497

18,867

35,909

Colombia

9,942

8,116

8,357

8,009

12,452

20,712

24,512

35,872

35,424

32,926

Japan

64,013

57,669

51,212

41,062

45,230

33,446

28,658

30,208

30,667

31,494

Subtotal :

640,419

635,198

647,834

622,469

782,464

968,414

1,633,189

1,129,394

1,087,661

1,135,411

All Other:

226,491

199,837

214,922

258,024

287,723

356,779

349,844

424,735

495,092

396,378

Total

866,910

835,036

862,756

880,493

1,070,187

1,325,192

1,983,033

1,554,128

1,582,753

1,531,789

2010 Toy Exports NAICS 33993 (In $1,000)

7 ITA does not consider Paraguay's imports of U.S. manufactured toys to be indicative of Paraguay's domestic

consumption.

The top five export destinations were Canada, Paraguay, Mexico, Hong Kong, the United

Kingdom, and Chile. Combined, Canada, Paraguay, and Mexico accounted for 53 percent of toy

exports.

The toy industry imported $21.427 billion worth of toys, dolls and games in 2010, an increase of

5 percent over 2010 levels.

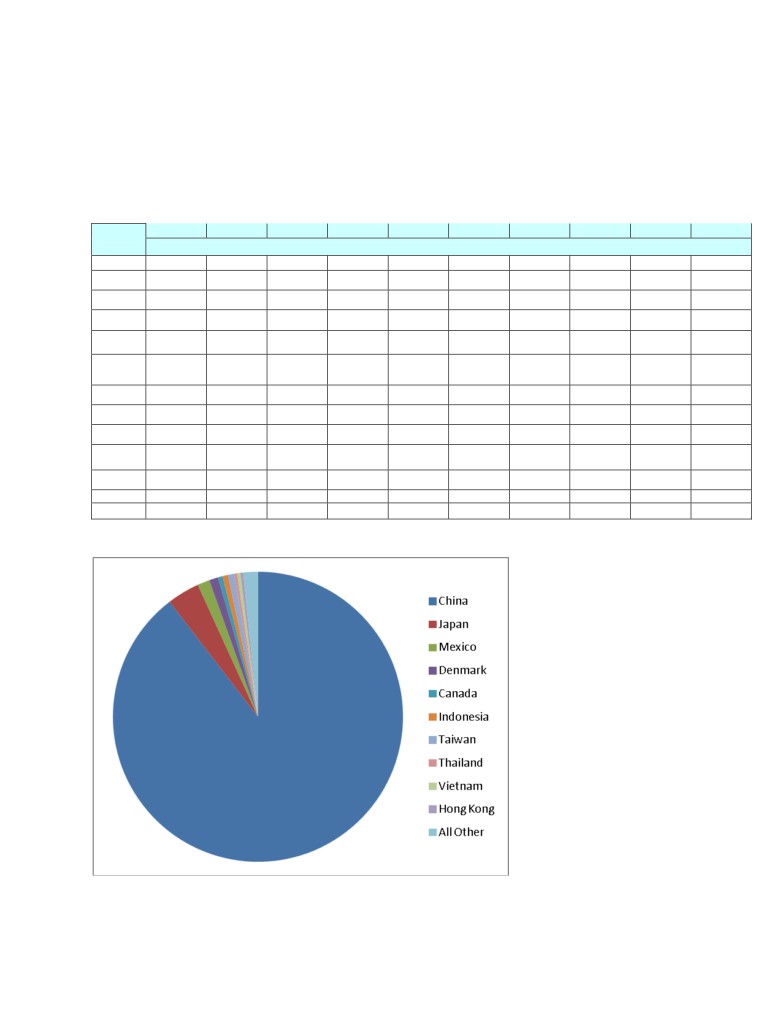

Toys, Dolls, and Games NAICS 33993: Customs Value U.S. Imports for Consumption

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Country

In 1,000 Dollars

China

8,742,865

10,428,832

11,660,592

12,053,678

13,439,770

14,592,830

19,446,731

20,677,929

18,330,413

18,979,444

Japan

3,206,034

2,055,828

690,227

604,364

1,270,560

885,981

843,295

758,488

741,681

692,406

Mexico

552,629

1,029,327

395,910

317,211

318,359

312,178

304,603

294,328

276,086

339,744

Denmark

122,514

135,999

89,721

98,434

115,753

129,908

163,019

108,428

205,568

278,733

Canada

193,475

177,410

159,007

141,325

134,937

106,009

89,158

104,653

109,226

240,197

Indonesia

119,832

110,847

107,581

93,180

89,607

77,291

97,998

114,322

121,991

173,598

Taiwan

207,893

202,406

191,513

186,723

172,279

169,196

196,115

170,703

143,869

153,923

Thailand

109,060

101,648

97,252

77,220

76,955

93,301

70,549

91,940

66,706

86,006

Vietnam

309

6,505

5,390

10,851

23,868

28,144

42,103

48,420

73,215

81,545

Hong

194,399

209,715

201,480

196,486

158,266

174,140

127,050

95,891

63,360

69,780

Kong

Subtotal

13,449,010

14,458,517

13,598,673

13,779,472

15,800,354

16,568,977

21,380,621

22,465,103

20,132,115

21,095,376

Other:

751,673

603,592

575,198

464,609

443,293

403,022

388,267

355,178

291,870

332,509

Total

14,200,683

15,062,108

14,173,871

14,244,081

16,243,647

16,971,999

21,768,888

22,820,281

20,423,985

21,427,885

2010 Toy Imports NAICS 33993 (In $1,000)

The top five import sources were China, Japan, Mexico, Denmark, and Canada. Chinese

produced toys accounted for approximately 88 percent of all toy imports in 2010.

U.S. apparent consumption of toys was approximately $22.2 billion in 2010 with imports from

China accounting for 85 percent of the total.

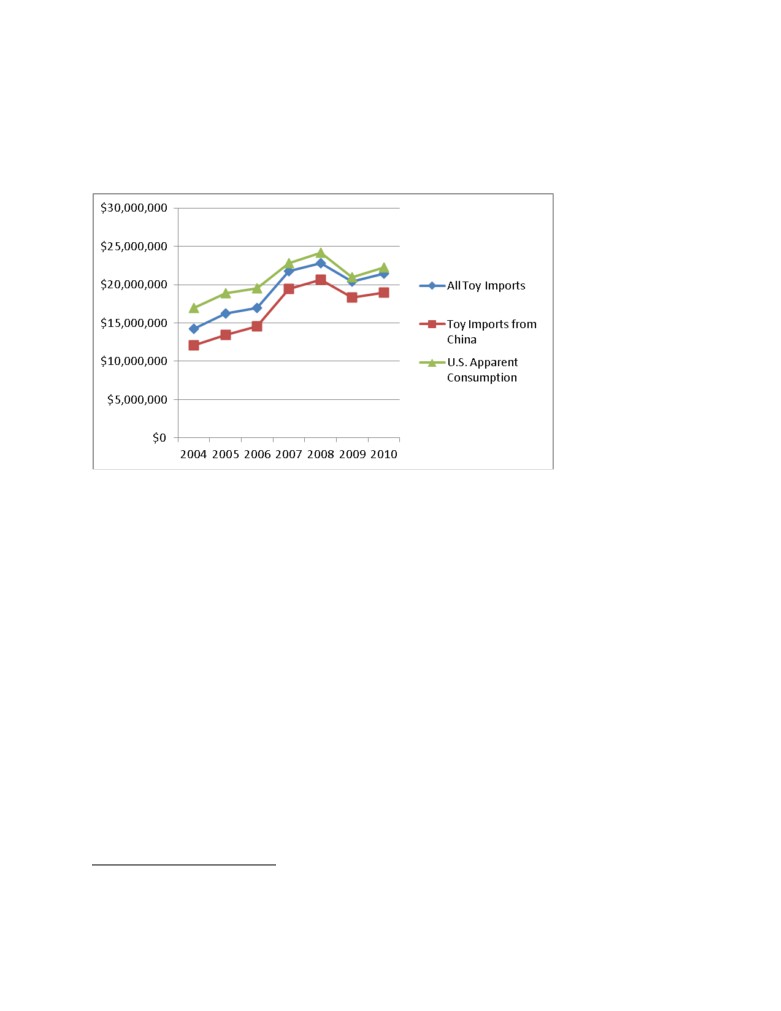

U.S. Toy Imports NAICS 33993 vs. Apparent Consumption and Toy Imports from China

U.S. and Foreign Toy Tariffs

The U.S. toy industry faces relatively low foreign tariffs. U.S. toy tariffs were reduced beginning

in 1995, and eliminated by 1999, as part of the GATT Uruguay Round "Zero-for Zero''

negotiations. Other signatories to the agreement include the European Union, Japan, and

Korea. Toy trade between Canada, Mexico and the United States is duty free under the NAFTA

agreement. As part of China's accession to the World Trade Organization (WTO), it eliminated

tariffs on most toy categories in 2005.

In 2011, Free Trade Agreements were signed with Korea, Columbia, and Panama. Current 2012 average

toy tariffs8 on U.S. made toy products are: Korea 4.7 percent; Columbia: 18.5 percent; and Panama:

10.4 percent. Toy tariffs in Korea will be reduced to zero upon implementation of the agreement. Toy

tariffs in Columbia will decrease to 0 percent after a 10 year staging. Toy tariffs in Panama will be

reduced either upon implementation, or using a five or ten year staging period.

In December 2011, Russia was invited to join the WTO as the 155th member. After full

implementation of its WTO commitments, toy tariffs which range from 5-20 percent will be

reduced and bound between 5-15 percent depending on the product category. Russia is

expected to formally join the WTO in 2012.

8 Toys are defined as chapter 95 of the U.S. Harmonized Tariff Schedule. Specific toy rates provided in this report

are for headings 9501, 9502 and 9503. FTA Tariff rates for other headings are available through the Department

of Commerce's Free Trade Agreement Tariff Tool.

U.S. toy companies still face tariffs ranging of up to 10-20 percent in South American countries

such as Brazil, and Asian countries such as Indonesia, Vietnam. For current tariffs on U.S.

products contact the Trade Information Center or call 1-800-USA-TRADE.

While U.S. toy companies generally enjoy relatively low tariffs in key export markets, they can

still encounter non-tariff barriers to these same markets. Companies that encounter problems

exporting are encouraged to report their problem to the International Trade Administration's

Trade Compliance Center. The U.S. Department of Commerce working in conjunction with

USTR and the Commercial staff at Embassies abroad have resolved numerous non-tariff trade

barriers for U.S. companies including issues pertaining to import licenses, safety standards, and

labeling requirements.

Industry Legislative Changes and Toy Recalls

In 2007, more than 45 million toys and other children's products were recalled for hazards such

as lead paint and small powerful magnets that could injure children if swallowed. Stakeholders,

including toy manufacturers, retailers, and consumer groups, participated in numerous

Congressional hearings which resulted in significant changes to the standards and testing

procedures applied to domestically produced and imported toys and children's products. On

July 31, 2008, Congress sent President Bush a compromise bill, H.R. 4040, entitled "Consumer

Product Safety Improvement Act of 2008.'' The Act impacted the U.S. toy industry in the

following ways:

Children's products

that contain lead above 600 parts per million for the first year,

reducing to 100 parts per million beginning the third year following the enactment of the

Act, will be treated as banned hazardous substances. The limits represent some of the

lowest lead limits in the world and effectively bans lead from children's products.

Third party testing and certification for certain children's products will be mandatory.

Children's products will be required to bear tracking labels that would allow their path

from factory to store to be more easily retraced in the event of a recall.

Toys and games advertised for sale on the internet and in catalogs will be required to

prominently display the same cautionary language included on product packaging

The voluntary industry standard ASTM F-963 will become a mandatory standard overseen

by the Commission.

Phthalates are a group of chemicals added to plastic toys and other plastic products to

make them soft and pliable. The phthalates DEHP, DBP, and BBP would be banned above

concentrations of 0.1 percent. Until the results of a Chronic Hazard Advisory Panel have

been received, the phthalates DINP, DIDP, and DNOP will be banned above concentrations

of 0.1 percent in any children's toy or childcare article that can be placed in a child's

mouth.

The Consumer Product Safety Commission website has numerous informational resources to

help stakeholders understand how the Act's requirements will be implemented including

downloadable video files of recent public meetings and timelines which summarize the

required actions pursuant to the Act.

The APEC Toy Safety Initiative

The APEC Toy Safety Initiative was the U.S. response to the many notable toy recalls of 2007,

and to APEC Leaders' calls in 2007 and 2008 to "strengthen consumer product safety standards

and practices in the region'' and "to undertake work to ensure the safety of toys.'' The project

was managed by the U.S. Department of Commerce's Office of Health and Consumer Goods

and the ITA's Standards Liaison in conjunction with USTR. The Initiative was cosponsored by

seven APEC economies: Chile, China, Chinese Taipei, Japan, Malaysia, and Viet Nam. TIA was

the U.S. private sector partner and contributed half of the operating funds. The Initiative called

for a survey of current toy regulatory practices of all APEC member economies and two events:

"A Regulator Dialogue on Toy Safety,'' held on the margins of the Singapore SCSC meeting

August 1-2, 2009; and "An Open Dialogue on Toy Safety for All Stakeholders'' (Open Dialogue)

held during the Hong Kong Toy Fair on January 12, 2010.

The two Dialogues marked the first-ever meetings of all toy industry stakeholders within the

APEC region (home to over 85% of all toy manufacturers and exporters) to discuss

opportunities and obstacles to global standards alignment. The Singapore meeting was

attended by 130 regulators from 20 of the 21 APEC economies (only Russia was not

represented). The Hong Kong meeting was attended by 214 people representing regulators,

standards bodies, toy manufacturers, retailers, toy associations, testing companies, and other

government representatives. Non-APEC attendees included Belgium, Denmark, India, Sweden

and Switzerland. There was discussion of the regulatory systems of 15 members, and the

relationship between the three main toy standards, ASTM F963, the EU's EN-71, and ISO 8124.

Key Outcomes from Singapore

? Commitment to participate in a survey of member economies regarding toy safety

systems as a deliverable to the Hong Kong meeting.

? Agreement between the ASTM and ISO technical committees to consultations on

emerging toy safety hazards.

Key Outcomes from Hong Kong

? Completion and endorsement of the APEC Toy Safety Survey and circulation of the

document to the OECD, WTO TBT Committee and related organizations.

? Agreement by APEC members to continue to pursue standards alignment in all

stakeholder groups through an industry task force, international regulator forums, and

consumer organizations under the auspices of the APEC Toy Safety Initiative.

? Commitment by CPSC to dedicate resources for global toy standards alignment in its

2010 workplan entitled "Plan for International Coordination on Toy Safety

Requirements'' (released May 2011).

Questions related to this industry report should be directed to the toy industry analyst at

Jamie.Ferman@trade.gov

Updated 4-22-2013