February 13, 2026

October 2009 | Vol. VIII - No. 10

Private Labels Are Coming to Toy Land

The Big Four Go After Better Value Under In-House Direction

| “All four major toy retailers … have significantly expanded their offering of economy brands or are in the process of doing so.” |

October 7, 2009 – A Nielsen report from late November 2008 states that sales of private-label brands in the United States in all categories grew to $81 billion in 2008, a 10.2 percent year-on-year increase versus 2007. Meanwhile, overall retail sales in 2008 dropped by 8 percent. The reason for this trend is obvious. In tough times, private label products tend to represent much better value at similar quality levels compared to branded products.

This trend has now caught up with toys big time. All four major toy retailers — Amazon, Target, Toys “R” Us and Wal-Mart — who collectively account for nearly three-quarters of the U.S. toy business, have significantly expanded their offering of economy brands or are in the process of doing so. Each does it slightly differently and I am below describing the strategies of each:

This trend has now caught up with toys big time. All four major toy retailers — Amazon, Target, Toys “R” Us and Wal-Mart — who collectively account for nearly three-quarters of the U.S. toy business, have significantly expanded their offering of economy brands or are in the process of doing so. Each does it slightly differently and I am below describing the strategies of each:

1. Amazon

There are increasing reports that Amazon is moving into private label products. While these have not yet included toys, it is my understanding that Amazon’s policy in this respect is under review. At this point, Amazon is continuing to quietly opt for exclusives rather than for private label products in their toy portfolio, but that is likely to change in the very near future. However, unlike Target, Amazon is expected to source these private label toys from its existing vendors rather than going directly to sub-contractors.

2. Target

2. Target

Ever since Wal-Mart instituted Project Impact, Target has been watching it like a hawk. Wal-Mart’s policy of focusing on heavily advertised and promoted toy brands on one hand and strengthening its offering of economy priced products on the other struck Target managers as something they might want to emulate. Until recently, Target’s private label offering had been something of an afterthought, typically representing about 3 to 4 percent of its toy sales, and this percentage was reflected in the shelf space allocated to it. This changed in late July when Target unveiled its new private label offering and allocated somewhere between 20 and 25 percent of its toy space to these newcomers.

Target's owned brands include Circo and Playwonder, among the "wide assortment of toys ... that are either only at Target or are exclusive at mass retail," Michaela Gleason, a spokesperson for Target, told TDmonthly.

At the same time, I notice that the space remaining for branded products favors heavily promoted brands — Mattel’s Barbie, Hasbro’s Transformers, Spin Master’s Bakugan, Hasbro’s Nerf, Hasbro’s Littlest Petshop, etc. — and I get the impression that the number of SKUs has been reduced. In other words, Target is now following a policy very similar to that of Wal-Mart.

These products are extremely well priced and there is a reason for this: Target has cut out the middleman altogether. These private label toys were designed in-house at Target and then manufactured by subcontractors in China. The focus on cost is clearly reflected in the packaging, which is effective but not at all overbearing.

These products are extremely well priced and there is a reason for this: Target has cut out the middleman altogether. These private label toys were designed in-house at Target and then manufactured by subcontractors in China. The focus on cost is clearly reflected in the packaging, which is effective but not at all overbearing.

3. Toys “R” Us

The recent arrival of Mark Murphy and his appointment to senior vice president of “R” Us brands is widely expected to presage a shift in the toy product mix, favoring a much stronger emphasis on private label. Mark earned his spurs at Tesco in private label efforts and has been responsible for Target’s recent shift into private label (see above).

We can hence look forward to a major revamping of the Toys “R” Us private label effort. As an executive who is knowledgeable in all issues concerning production in Asia, I would not be surprised if we found the private label product development and manufacturing migrating away from current vendors to a program totally administered and executed in-house.

4. Wal-Mart

Wal-Mart’s strategy is totally different from that of its three main toy competitors. Wal-Mart has, for years, had private label offerings in toys, notably Kids Connection, but never really got much traction. Management has recognized that there are certain things they do well — namely retailing — and certain things that are not their forte — product development and marketing for toys being two of them.

Yet, they do want to continue to offer the consumer a good alternative to more expensive branded products. They squared this circle by making deals with second-tier vendors, whereby these companies would create high-quality product ranges in key toy categories under their own brands, allowing Wal-Mart to sell these at very significantly lower prices. These are not private labels, per se, in that the manufacturer sells products under its own brand and may sell to other retailers provided it does so at prices that are not below those at which the products are sold to Wal-Mart.

Yet, they do want to continue to offer the consumer a good alternative to more expensive branded products. They squared this circle by making deals with second-tier vendors, whereby these companies would create high-quality product ranges in key toy categories under their own brands, allowing Wal-Mart to sell these at very significantly lower prices. These are not private labels, per se, in that the manufacturer sells products under its own brand and may sell to other retailers provided it does so at prices that are not below those at which the products are sold to Wal-Mart.

There are a couple of conditions attached to this collaboration. The manufacturer has to sell the products at prices that allow Wal-Mart to retail them significantly below the targeted market leader. The manufacturer also has to promote and advertise the brand, feature it on its website, keep adequate backup stocks, and ship dependably. In return, Wal-Mart will give it adequate shelf space in all its Supercenters and terminate its own private label offering.

Two of these have now been launched.

The first one is an entry into the construction category, competing with Lego, Trio of Fisher-Price, Mega Brands and K’Nex. The manufacturer is Meccano and the brand is Erector. The package shows Wal-Mart as the distributor:

The first one is an entry into the construction category, competing with Lego, Trio of Fisher-Price, Mega Brands and K’Nex. The manufacturer is Meccano and the brand is Erector. The package shows Wal-Mart as the distributor:

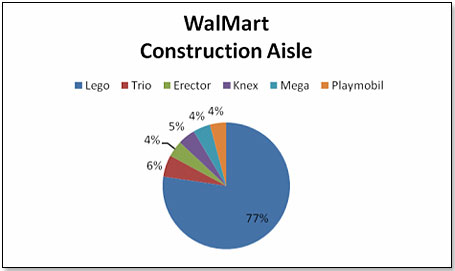

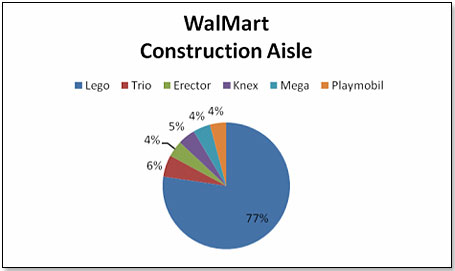

The products are sold at prices about 75 percent below those of Lego, Trio and Mega, and approximately on par with K’Nex. Wal-Mart has given space to Erector pretty much on par with everybody else except for Lego who, as the market leader, has much greater exposure:

Running Feet; Note: In addition to its in-shelf presence, Lego also has an endcap

Interestingly, Erector is also sold at Amazon and Toys “R” Us but without the Wal-Mart label and at much higher prices.

The second collaboration is in the preschool category. It’s the Baby Genius product range by Battat, which competes with Fisher-Price and Playskool and is sold by Wal-Mart on a non-exclusive basis. It is attractively presented, obviously of good quality, and at prices much lower than those of its two, much larger competitors.

The second collaboration is in the preschool category. It’s the Baby Genius product range by Battat, which competes with Fisher-Price and Playskool and is sold by Wal-Mart on a non-exclusive basis. It is attractively presented, obviously of good quality, and at prices much lower than those of its two, much larger competitors.

I saw seventeen SKUs, including Vinko’s Musical Broom shown above. The products pretty much cover all the major toy areas catering to pre-school, other than the Electronic Learning Category:

| Description |

Toy Type |

Price Per Piece |

| Lots to Do Car Keys |

Toy Keys |

$5.00 |

| Sort and Stack Fun |

Wooden Blocks |

$8.00 |

| Swivel and Sounds Phone |

Toy Phone |

$8.00 |

| Musical Camera |

Toy Camera |

$8.00 |

| Sea Life Bath Time Buddies |

Bath Toys |

$8.00 |

| Car Keys |

Toy Keys |

$8.00 |

| Vinko’s Musical Broom |

Music Box |

$10.00 |

| Race You There Sports Cars |

Toy Vehicles |

$10.00 |

| DJ’s Doctor Kit |

Playset |

$10.00 |

| Vinko’s Dump Truck |

Toy Truck |

$10.00 |

| Krinklers on the Go |

Construction |

12.00 |

| Jungle Fun Shape Sorter |

Puzzle |

$12.97 |

| Adventure Train Set |

Toy Train |

$13.00 |

| Cash Register |

Toy Cash Register |

$15.00 |

| Singing School Bus |

Toy Vehicle |

$15.00 |

| Discovery Puzzle Pack |

Puzzle |

$17.00 |

| Pet Care Center |

Toy Animals |

$18.00 |

The line is being supported by an advertising and marketing campaign targeting mothers with children 2 to 5 years old. Online advertising will extend to leading parenting websites such as NickJr.com, Noggin.com and DisneyChannel.com. On-air television advertising spots will run on Comcast and Cox VOD channels, where Baby Genius commands the No. 1 spot in children’s VOD on the Comcast Baby Boost Channel, with more than 10 million views per year.

It is my understanding that Wal-Mart is talking to other manufacturers to make similar arrangements.

Copyright © 2026 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.

This trend has now caught up with toys big time. All four major toy retailers — Amazon, Target, Toys “R” Us and Wal-Mart — who collectively account for nearly three-quarters of the U.S. toy business, have significantly expanded their offering of economy brands or are in the process of doing so. Each does it slightly differently and I am below describing the strategies of each:

This trend has now caught up with toys big time. All four major toy retailers — Amazon, Target, Toys “R” Us and Wal-Mart — who collectively account for nearly three-quarters of the U.S. toy business, have significantly expanded their offering of economy brands or are in the process of doing so. Each does it slightly differently and I am below describing the strategies of each:  2. Target

2. Target These products are extremely well priced and there is a reason for this: Target has cut out the middleman altogether. These private label toys were designed in-house at Target and then manufactured by subcontractors in China. The focus on cost is clearly reflected in the packaging, which is effective but not at all overbearing.

These products are extremely well priced and there is a reason for this: Target has cut out the middleman altogether. These private label toys were designed in-house at Target and then manufactured by subcontractors in China. The focus on cost is clearly reflected in the packaging, which is effective but not at all overbearing.  Yet, they do want to continue to offer the consumer a good alternative to more expensive branded products. They squared this circle by making deals with second-tier vendors, whereby these companies would create high-quality product ranges in key toy categories under their own brands, allowing Wal-Mart to sell these at very significantly lower prices. These are not private labels, per se, in that the manufacturer sells products under its own brand and may sell to other retailers provided it does so at prices that are not below those at which the products are sold to Wal-Mart.

Yet, they do want to continue to offer the consumer a good alternative to more expensive branded products. They squared this circle by making deals with second-tier vendors, whereby these companies would create high-quality product ranges in key toy categories under their own brands, allowing Wal-Mart to sell these at very significantly lower prices. These are not private labels, per se, in that the manufacturer sells products under its own brand and may sell to other retailers provided it does so at prices that are not below those at which the products are sold to Wal-Mart. The first one is an entry into the construction category, competing with Lego, Trio of Fisher-Price, Mega Brands and K’Nex. The manufacturer is Meccano and the brand is Erector. The package shows Wal-Mart as the distributor:

The first one is an entry into the construction category, competing with Lego, Trio of Fisher-Price, Mega Brands and K’Nex. The manufacturer is Meccano and the brand is Erector. The package shows Wal-Mart as the distributor:

The second collaboration is in the preschool category. It’s the Baby Genius product range by Battat, which competes with Fisher-Price and Playskool and is sold by Wal-Mart on a non-exclusive basis. It is attractively presented, obviously of good quality, and at prices much lower than those of its two, much larger competitors.

The second collaboration is in the preschool category. It’s the Baby Genius product range by Battat, which competes with Fisher-Price and Playskool and is sold by Wal-Mart on a non-exclusive basis. It is attractively presented, obviously of good quality, and at prices much lower than those of its two, much larger competitors.