February 16, 2026

At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers.

At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers.

“The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.”

“The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.”

| Date of Event | Event | Commentary |

3/1/2009 |

GameStop forms Digital Media Group | Focal point for all GameStopefforts and strategies relativethe digital market place |

| 8/5/2009 | GameStop appoints Chris Petrovic GameStop Digital Ventures | former VP of digital at Playboy |

| 11/4/2009 | GameStop appoints Shawn Freeman, VP and GM of Digital Business | Digital Business Former President, Tickets now and SVP Resale, Ticketmaster at Ticketmaster Entertainment |

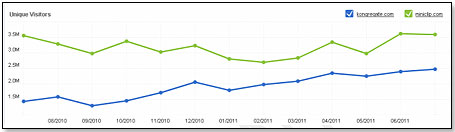

| 11/8/2010 | GameStop acquires Jolt Online | UK online gaming provider, competes against OnLive.com |

| 7/27/2010 | GameStop acquires Kongregate | Casual gaming social network, competes against Miniclip.com |

| 10/1/2010 | GameStop unveils PowerUp Rewards | Digital Loyalty Program |

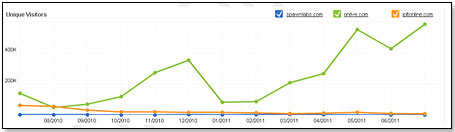

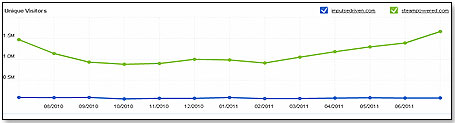

| 3/31/2011 | GameStop acquires Impulse | Digital distribution platform, competes against Steampowered.com |

| 3/31/2011 | GameStop acquires Spawn | Provider of streaming and virtualization technology, competes against OnLive.com |

| 7/31/2011 | GameStop begins offering online PC games at its retail locations | Permits trade-ins of boxed products for credit on digitals |

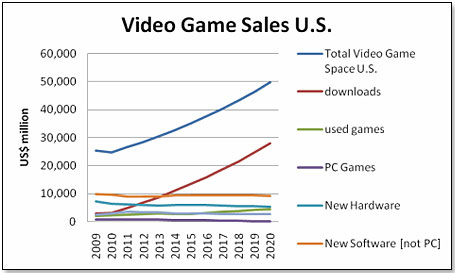

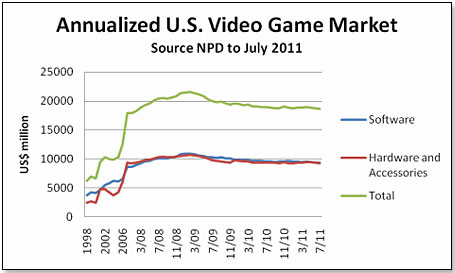

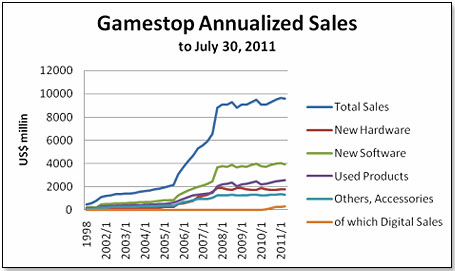

While Digital Sales are clearly not a major contributor at this point, it is one of only two growing categories – the other being sales of pre-owned products. In this, GameStop is very much in line with the market as projected in my first graph at the beginning of this article (Annualized Video Game Market U.S.).

While Digital Sales are clearly not a major contributor at this point, it is one of only two growing categories – the other being sales of pre-owned products. In this, GameStop is very much in line with the market as projected in my first graph at the beginning of this article (Annualized Video Game Market U.S.). If the tests designed to broaden the product base are not successful, then the only option over time is to cut store counts. This in turn will lessen GameStop’s attractiveness as a retailer to publishers and hardware manufacturers, who will then probably be persuaded to put increasing emphasis on going directly to the consumer via the digital route. This will result in increased pressure on GameStop’s stores.

If the tests designed to broaden the product base are not successful, then the only option over time is to cut store counts. This in turn will lessen GameStop’s attractiveness as a retailer to publishers and hardware manufacturers, who will then probably be persuaded to put increasing emphasis on going directly to the consumer via the digital route. This will result in increased pressure on GameStop’s stores.

Copyright © 2026 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.