November 15, 2025

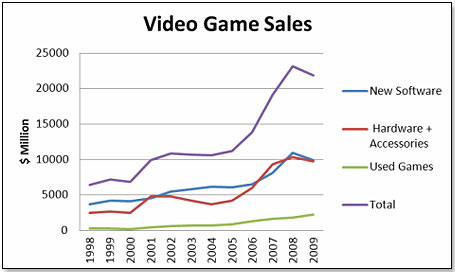

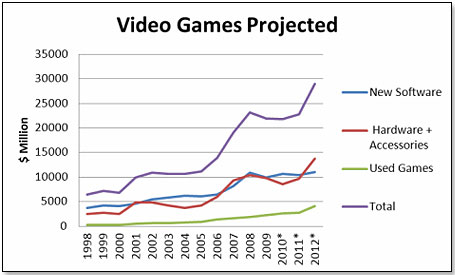

| “Unless these rumors are convincingly repudiated, we can look forward to a repeat of the 2001 to 2006 trend — declining new hardware and stagnating new software sales.” |

Copyright © 2025 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.