March 3, 2026

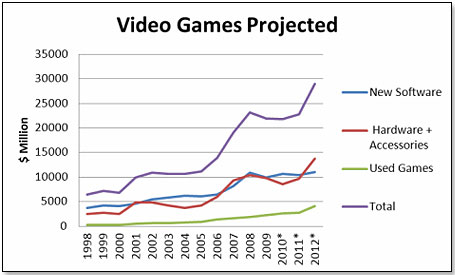

| “Unless these rumors are convincingly repudiated, we can look forward to a repeat of the 2001 to 2006 trend — declining new hardware and stagnating new software sales.” |

Copyright © 2026 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.