February 16, 2026

June 2012 | Vol. XI - No. 6

QUO VADIS HASBRO?

'Battleship' Sank, 'G I Joe' went AWOL - Is Hasbro on the road to defeat?

When talking to my Hedge Fund clients a few years ago, I predicted that Hasbro could challenge Mattel for supremacy in the toy world if they followed a few simple precepts.

One of them was that they should not rely on movies except as a small part of their product strategy because mothers do not consider the cinematic message as the non-plus ultra for their children’s upbringing. The second was that they should not think that TV or other licenses replaced creativity and innovation in the development of toys. The third was that they should sharply reduce their focus on video games given that this form of entertainment would eventually leave the brick-and-mortar universe Hasbro is so at home with. And fourth, finally, that starving cash cows in order to feed sexy new ventures would eventually lead to failure.

They did not follow these precepts and they are now likely to wander in the wilderness for at least two if not three years.

This is how I see their business developing this year and next.

Boy Category

This Hasbro category is almost totally driven by movies – both action figures and building toys (KreO). The only exceptions are BeyBlades and Nerf. Unfortunately, the movie line-up looked somewhat anemic this year in comparison with 2011, even before G I Joe was moved to 2013. While the move benefits next year, there is little consolation because 2013’s offering — even including G I Joe — is incredibly thin.

This is how Hasbro’s film tie-ins developed over the past six years and are expected to shape up in the next two:

With the move of GI Joe into next year, 2012 looks dicey given that the Avengers go up against Batman. Retail insiders are betting that the Avengers will drop off a cliff as soon as Batman goes up on the cinema screens. In other words Batman, not the Avengers, will dominate the all-important four toy-selling months between September and December.

Even with GI Joe in the 2013 lineup, Hasbro’s exposure next year is weak because their four movies (Iron Man, GI Joe, Star Trek and Thor) are all relatively weak toy generators and face a very competitive line-up in Lord of the Rings, Superman and the Turtles. 2014 is no better because Spiderman and Captain America face up against Avatar which again is expected to break all records.

What does not help Hasbro this year either is the fact that the Spiderman release was just moved from the original release date of June 9 date to July 3. Normally, this would not make too much of a difference. However, in this particular case, it shortens the run Spidey has before Batman hits from 41 days to 17 days. This will have no impact on Hasbro’s sell-in, which will occur unchanged, but it will make a significant difference to the sell-through from retailer’s shelves, and hence will impact Hasbro’s numbers later on.

As for the remainder of the Boys category — the toys not driven by movies — I also see declines unless major and so far not demonstrated innovation propels BeyBlades and Nerf. KreO, while a very respectable new entry into the building category, is also totally driven by movies and hence is likely to be at a competitive disadvantage versus Lego. Moreover, the recent acquisition by Mega Bloks of the Skylanders license is likely to further complicate KreO’s life given that the Skylanders have proven to be fantastically successful.

While the move of GI Joe into next year, and the virtual collapse of Battleship, has a negative effect on Hasbro’s sales, there is another and more serious consequence. Up to now, buyers at the large retailers pretty much took Hasbro’s word on anything as gospel. This has now changed. As one buyer put it to me yesterday: “I do not think I will give Hasbro as much latitude in the future. They totally screwed me up this time!”

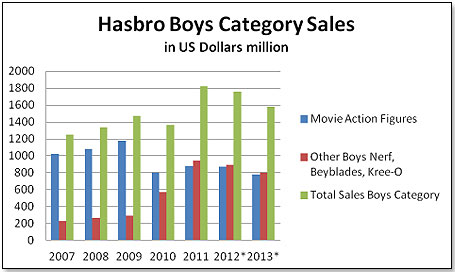

Putting it all into the hopper, this is how I see Hasbro’s Boy Category sales to develop this and next year:

Note that the 2012 and 2013 numbers do not include currency effects

see what Hasbro had to say about their Boy category

Girl Category

With the move of Furby to the Girls Category, Hasbro is resurrecting a very old pet to compensate for the continuing decline in Littlest Petshop, still today the largest component of this product group. In addition, they had some very interesting products to show at this year’s Toy Fair — specifically the New Totally Talented Pets range, Fairies and the Littlest Peshop Teensies and the Littlest Petshop Fairies.

The Teensies are out and on ToysRUs shelves; the Fairies are available at TRU but only online. One of my friends at this retailer told me that neither is making any major waves and they are hence a little unlikely to check the continued slide of the Petshop range.

In addition, Hasbro’s Girl Category is beset by three very active and successful competitors — Squinkies by Blip Toys, Zoobles by Spinmaster and, most importantly, Lalaloopsy by MGA.

I believe, and this is shared by my friends at retail, that Furby will definitely turn Hasbro’s Girl Category back to growth this year if for no other reason than that sell-in will be massive. I also understand that Hasbro will put a lot of muscle behind the launch and all three major retailers are going to give the brand some very nice shelf space.

see what Hasbro had to say about their Girl category

Preschool

Hasbro stole a march on Mattel in late 2011 when they succeeded in getting the Sesame license transferred to them and away from their foremost competitor. There is no question that Sesame started off very well in the fourth quarter last year and has performed to the satisfaction of all parties involved (including, notably, Sesame Workshop, the owners of the brand). However, that does not mean that Hasbro has performed equally well for the remainder of the category.

Much more seriously, with the acquisition of HIT Entertainment Mattel has totally upended the competitive landscape facing Hasbro in the years ahead.

First a look at their Preschool business. If you black out Sesame, the category was down double digits in 2011 and it looks that it will have a similar decline this year.

I spoke to one of my friends involved with the category at a large U.S. retailer and this is what she thought: “Yes, Hasbro has some very nice preschool stuff but they are missing a major opportunity because their branding is all over the shop. Unlike Fisher-Price where all promotion and advertising is focused on the overall brand, Hasbro promotes sometimes the umbrella brand — Playskool — sometimes the product individual brand (Furreal) and sometimes a combination of both. As a result, the brand’s personality gets lost in the shuffle.”

Maybe yes, maybe no. It is impossible to make yourself a coherent picture of Hasbro’s preschool business. And if a buyer has such problems, chances are that the consumers have these even more so. In the case of Mattel, it’s easy — it is Fisher-Price, period. Fact is that Hasbro’s Preschool business is not doing well and branding may have something to do with it.

But this is not the major problem. The major problem is the fact that Mattel acquired HIT Entertainment late last year. HIT’s business was to own toy brands such as Thomas, Barney, Bob The Builder, Mike The Knight and many others and to license the rights to sell these products. They did so all over creation — including the U.S. UK, Russia, Germany, Australia, etc.

While the exact sales number for all these properties with all the licensees is not known, estimates of their toy license income put it into $80 million neighborhood. As an average, you look at license rates of between 8% and 10% on sales of product by the licensees and at license deals not exceeding five years. This would translate to top line sales of $900 million today. Of this, Mattel already has the non-wooden part of Thomas at an estimated sales figure oft $150 million.

In other words, if Mattel does nothing else but just transfer these licenses to their Fisher-Price portfolio as their contract period comes to an end, they will have increased their sales result by about $750 million. However, they are unlikely to just sit back and count their pennies.

HIT has a total of ten brands, of which only Thomas & Friends is today well known in the United States. The other brands are a factor only internationally, mainly in Europe — Bob The Builder, Fireman Sam, Angelina Ballerina, Kipper, The Wiggles, Mike the Knight, Pingu, Barney, and Rainbow Magic. There is no doubt in my mind that Mattel will establish these brands globally. This fact, and the benefit of having a coherent marketing strategy around the globe, will in all probability double the sales number of $750 million by 2020.

In other words, even if there is absolutely no growth in the current Fisher-Price products between now and then — a very unlikely assumption, in my opinion — the line will go from the estimated 2012 sales volume of $2,350 million to about $4 billion. Mattel will hence totally dominate the preschool market worldwide. And this leaves Hasbro a very, very distant Number Two with all the disadvantages this entails.

see what Hasbro had to say about their Preschool category

Games and Puzzles

With the sinking of the Battleship movie, a whole marketing strategy went under as well.The Battleship was to have been the first movie that paired a board game and a cinematic effort. After Battleship, there were to have been at least another three movies — Monopoly, Ouija and Candyland. This is now somewhat unlikely to happen.

The Games and Puzzles Category was until relatively recently not only Hasbro’s largest but also, by far, the most profitable — and, as some said, unrealistically so. It was used pretty much as a cash cow to support the other categories. This profitability had to be protected at all costs regardless of consequences to the brands. So the cash cow was starved.

Competitors were not slow to see the opportunity and there were particularly two — Mattel and Lego — who went in with everything they had. Mattel bought Blokus a few years ago and licensed Angry Birds late 2011. Lego first launched their board games in Europe three years ago, and brought them to the United States in 2010.

At the end of May, ToysRUs reported that its top board game was Lego’s Minotauros, #2 was Pictionary by Mattel, #3 Chuggington Matching Game by Wonder Forge, #4 was Angry Birds by Mattel and, finally, #5 was Hasbro’s Connect4. Only a few years ago you would have expected Hasbro to occupy all five positions.

Life caught up with Hasbro and its Board Game business. In terms of sales, 2009 was flat compared with 2008; 2010 was down some 3%; 2011 was down nearly 10%; and 2012 is expected to drop by nearly the same percentage.

In May last year, the company finally faced up to its problem, at least in a fashion. They decided to fire more than half of its game development personnel in East Longmeadow, Mass., and to transfer the remainder to a newly created Center of Excellence in Rhode Island. This center was designed to devote itself to the development of both traditional board games and digital games. Phil Jackson, the Group Executive of Games at Hasbro, went and was replaced by Senior VP Eric Nyman who before this appointment headed Hasbro’s Boys Category.

So far, nothing major has emerged as a consequence of these moves. Yes, Hasbro presented at Toy Fair a fairly modest range of zAPPed games — games mixing analog and digital game play. Also, the company recently began offering an iPhone app for Monopoly. Hasbro also made a deal with Zynga whereby Zynga’s online games are turned into board games by Hasbro. Finally, Hasbro has also begun a fairly widespread rebating campaign at the major retailers for a wide variety of their board games.

However, none of these actions will have a major impact on Hasbro’s weakening competitive position in the board game sphere. Buyers tell me that Hasbro is indeed working on a wide range of new games but they do not expect these to become available much before 2014. Until then, Mattel and Lego are expected to continue eating market share.

see what Hasbro had to say about their Games & Puzzles category

Overall Assessment

While one should never count Hasbro out, all indications are that the company is struggling on virtually every front you can imagine.

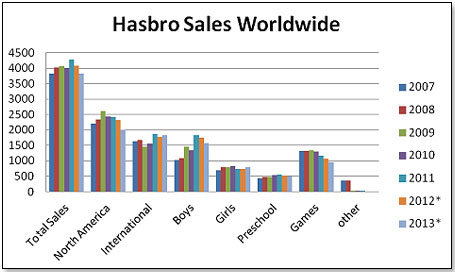

We talked in this article about the major product groups and the difficulties the company faces. These difficulties are best demonstrated in the chart below.

Note that the 2012 and 2013 numbers do not include currency effects

What are Hasbro’s choices? If you assume that their efforts in developing new Board Games will succeed over the next two years, and that they will find new and exciting film properties, and that their international efforts continue to move forward as they have been over the past few years — then, yes, there is light at the end of the tunnel. However, I do not think that all these efforts will be enough to stop Mattel’s increasing dominance — particularly in the preschool field — unless Hasbro, too, takes the acquisition route in a big way.

Incidentally, I would not write this article without giving Hasbro an opportunity to have their say. I hence asked Wayne Charness, senior vice president of corporate communications for Hasbro, for comments on a series of questions by email. You can see his response here.

Copyright © 2026 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.