|

Tools:

Toy Manufacturing Costs are Rising – what are the choices?As China gets more expensive, where will toy companies head?

I predicted earlier this year that toys produced in China were going to be more expensive this year, and in the August issue of this magazine I predicted that overall, including the effect of the rising Renminbi (the official currency of the People's Republic of China), the increase would be in the neighborhood of 20%. The fact that China produces about 90% of all the toys sold in the United States raises the question as to how the executives of the various toy manufacturers are going to cope with this trend. I predicted earlier this year that toys produced in China were going to be more expensive this year, and in the August issue of this magazine I predicted that overall, including the effect of the rising Renminbi (the official currency of the People's Republic of China), the increase would be in the neighborhood of 20%. The fact that China produces about 90% of all the toys sold in the United States raises the question as to how the executives of the various toy manufacturers are going to cope with this trend.

First, the numbers. Actuals so far this year have in fact worked out to be virtually identical to my prediction. These are the numbers as reported by BRI-Cache Sales on one side, and private label cost data from one major retailer on the other. BRI-Cache is an up and coming toy manufacturer who designs in the USA, manufacturers in China and who sells its products to WMT, TGT and TRU:

| Cost Component |

% of Cost 12/2010* |

Cost Increase as per BRI-Cache % |

Result 12/2011 |

Cost Increase as per Mass Retailer % |

Result 12/2011 |

| Freight/Logistics |

11.80 |

11.50 |

13.16 |

10.50 |

13.04 |

| Labor |

20.95 |

28.00 |

26.82 |

29.00 |

27.02 |

| Resins |

13.25 |

14.00 |

15.11 |

14.00 |

15.10 |

| Power |

7.70 |

6.00 |

8.16 |

6.00 |

8.16 |

| Packaging |

18.75 |

15.00 |

21.56 |

14.50 |

21.47 |

| Other Direct |

16.55 |

10.00 |

18.21 |

12.00 |

18.54 |

| Overhead |

11.00 |

6.00 |

11.88 |

5.00 |

11.55 |

| Total COGS |

100.00 |

|

114.82 |

|

114.88 |

| Forex** |

100.00 |

4.925 |

4.93 |

4.925 |

4.92 |

| Total |

100.00 |

|

119.75 |

|

119.80 |

*as reported by a major U.S. toy manufacturer early 2011

** as reported by China Foreign Exchange Trading System 11/2/2011

Under normal circumstances, toy manufacturers faced with such cost increases would simply go to the retailers and ask for a price increase. Not this year, though. The last increases granted by the large retailers were in April. A number of manufacturers went back to the well in July and August and asked for an encore. The got an emphatic “NO” – no price increases in the all-important fourth quarter. So, how did the various toy makers cope?

Jim Fife, CEO of BRI-Cache opted for the cost reduction route:

“To offset these increases we have tried to consider how we can keep the quality of the toy up but reduce some of the actual product content. This has to happen during the design stage; getting design, manufacturing and sales aligned on our goals is key to making this happen. We have challenged our pack quantities and our retail package dimensions to save on logistics. We have looked at ways to add more play value by taking out some features that were either not necessary or not really benefiting the child. We have reduced packaging, keeping enough to tell the story and protect the toy but nothing extra. The retailers understand cost increases but they very much appreciate a proactive approach to holding costs in the very challenging environment. To stay competitive we have taken the approach that all facets of the business must be aligned on looking to save costs. From design to engineering to manufacturing to packaging to on shelf presentation, everything has to be scrutinized in order to keep cost increases to a minimum. We have even had to renegotiate licensing contracts so that we could keep certain items at certain price points. I have found that once you are established with a licensor and you are doing your best to maximize royalty payments they will work with you on an item by item basis to keep retail price points where they need to be in order to maintain shelf presence and drive the volume.” “To offset these increases we have tried to consider how we can keep the quality of the toy up but reduce some of the actual product content. This has to happen during the design stage; getting design, manufacturing and sales aligned on our goals is key to making this happen. We have challenged our pack quantities and our retail package dimensions to save on logistics. We have looked at ways to add more play value by taking out some features that were either not necessary or not really benefiting the child. We have reduced packaging, keeping enough to tell the story and protect the toy but nothing extra. The retailers understand cost increases but they very much appreciate a proactive approach to holding costs in the very challenging environment. To stay competitive we have taken the approach that all facets of the business must be aligned on looking to save costs. From design to engineering to manufacturing to packaging to on shelf presentation, everything has to be scrutinized in order to keep cost increases to a minimum. We have even had to renegotiate licensing contracts so that we could keep certain items at certain price points. I have found that once you are established with a licensor and you are doing your best to maximize royalty payments they will work with you on an item by item basis to keep retail price points where they need to be in order to maintain shelf presence and drive the volume.”

One large retailer [who prefers to remain anonymous] resorted to a haircut:

“We typically make a larger than normal margin on private label products in comparison to those we buy from regular manufacturers. Since we really did not want to increase prices, we chose to absorb these increases in costs ourselves and to leave our retail prices untouched.”

Russ Hornsby, CEO of Cepia LLC of Zhu Zhu Pets fame, had the following to say:

“Our strategy is to bring out exciting and successful new products every year and we therefore have little problems handling cost increases for older ones. This year we released Dagedar and Xia Xia Hermit Crabs. The former is doing exceptionally well and the latter is getting nice traction. “

And then are those few who never went to China but stayed right here in the U.S.. Michael Araten, CEO of K’Nex Brands, is one of them:

“We are benefitting from the importance of goods made in America. As the only toy company making toys on a mass scale in the United States, we have a unique competitive advantage. We made the decision about 4 years ago to make certain that over 95 percent of the parts are made at The Rodon Group (our wholly owned manufacturing subsidiary). Domestically made products are a central topic of our national discussions about how to keep the US economy growing. The USA is also the largest toy market in the world. So, we have tapped into a collective consciousness. It also allows us to do 2 key things for consumers. Over 80 percent of our toys retail for less than $30 (with over 50 percent below $15), and they are typically a 30-50 percent better value than our competition. When you couple that with toys that focus on building worlds kids love, like Mario Kart, Sesame Street, Top Gear, NASCAR and Monster Jam we have put together an incredibly compelling portfolio that kids love and families can afford.”

And, of course, a 20% hike in Chinese manufacturing costs now significantly narrows the price disadvantage Mr. Araten has faced over the years and which he overcame by being very cost focused, more creative, and simply nimbler that most of his competitors. Incidentally, a very similar statement could be made for Lego who, just like K’Nex, do not produce in China but in Europe and Mexico.

In August, the Boston Consulting Group issued a report under the title “Made in America. Again.” In this they postulate that China’s era as a low cost producer will in five years be pretty much over, for the following reasons:

- Salaries and benefits are expected to increase across-the-board at a more than 15% rate per year for the foreseeable future. For minimum wage workers, like the people working in the Shenzhen toy factories, this is likely to be nearer 30%.

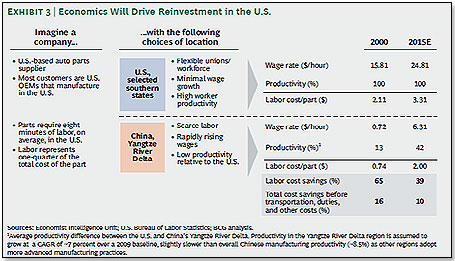

- This means that the total hourly cost of a worker in the Yangtze River Delta, which includes Shenzhen, will in the next five years rise by an annualized 18% to $6.31 per hour, compared to the $0.72 per hour in 2000.

- The actual cost differential between the U.S. and China is, as per the chart below, expected to dwindle to 10% by 2015.

- The other costs referred to in the chart above are things like electricity [up 15% since 2010], shipping and the Renminbi exchange rate.

The fact that China will become as expensive a manufacturing place as the U.S. does not mean that all factories will come back home. There are other low-cost producing countries such as Indonesia, Thailand, Vietnam, India etc. However, they all have major issues in the areas of logistics, infrastructure and educational levels, which have a significant impact on labor productivity and costs.

So, what are the likely choices for a U.S. toy manufacturer?

The answer is a toss-up between the U.S. and Mexico. In terms of overall costs, the real winner will in all likelihood be Mexico – the country already chosen by Lego. In the year 2000, Mexican workers were paid four times as much as their Chinese counterparts. By 2010 the difference dwindled to one-third. By 2015, Chinese workers are expected to be paid 25% more than their Mexican brethren. In addition, because of NAFTA, Mexican goods can enter the U.S. free of duty, and at a tremendous logistical advantage - shipments from Mexico to the U.S. average 2 days whereas the same shipment from China will take three weeks. Exchange rates should not be an issue either – in fact, the Mexican Peso dropped in value versus the US Dollar by 15% in the last two years. The answer is a toss-up between the U.S. and Mexico. In terms of overall costs, the real winner will in all likelihood be Mexico – the country already chosen by Lego. In the year 2000, Mexican workers were paid four times as much as their Chinese counterparts. By 2010 the difference dwindled to one-third. By 2015, Chinese workers are expected to be paid 25% more than their Mexican brethren. In addition, because of NAFTA, Mexican goods can enter the U.S. free of duty, and at a tremendous logistical advantage - shipments from Mexico to the U.S. average 2 days whereas the same shipment from China will take three weeks. Exchange rates should not be an issue either – in fact, the Mexican Peso dropped in value versus the US Dollar by 15% in the last two years.

However, Mexico is not without its problems and internal security is a major one, at least today. In other words, a toy executive in the U.S. might well chose to be able to sleep peacefully at night knowing that his factory is just around the corner rather than in a drug-rife battle zone two thousand miles away, even if this means a somewhat more expensive product.

Forklift photo courtesy of Jelaga

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|