|

Tools:

The Future of GamestopGameStop is struggling — and the Wii U can't save it

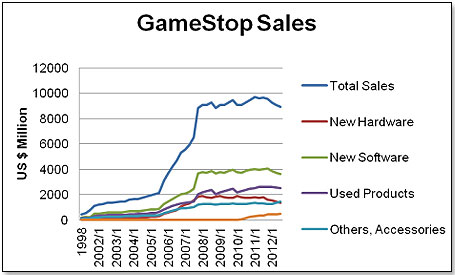

There is no question that GameStop has had a tough time of late. There are any number of reasons given – we are at the tail end of the last console cycle, there is a shift from consoles towards mobile phones and tablets, downloads are taking more and more share away from the brick—and—mortar retailers — but whatever the case may be, GameStop is struggling and the third quarter 2012 results just now published show no let-off in this pattern:

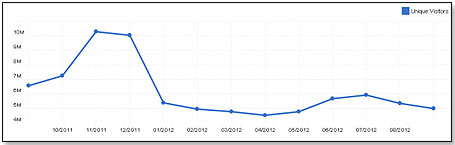

Also, the company's web traffic shows a similar picture and this in spite of their avowed determination to channel more business via their website:

Yet, not all is lost, at least for the fourth quarter. GameStop will have a couple of humongous releases – one is the Wii U, the second Halo 4 and the third CoD Black Ops 2. There has also been the release of Assassins Creed 3 on October 30th, which should contribute nicely during this quarter as well. All three titles promise to do extremely well and to significantly exceed the sales of their predecessors, which should provide a lift to GameStop's numbers.

In addition, GameStop also benefits from the absolutely outstanding success of the Skylanders, particularly after the release of the Giants on October 21. I would expect this to result in yet another quarter where the Accessories sales exceed last year's numbers.

However, the most important of releases this year is that of the Wii U, the first entrant in the new console cycle. Wii U will become available on Sunday, November 18, and is expected to sell 3.5 million units until end of the year – up from the 3.1 million units the Wii sold in 2006 when first released. GameStop is likely to move 450,000 units in the same time period, or about $150 million in sales. As a result, the company should for the first time in a long while show an up-tick in new hardware sale numbers.

This will not change the fact that GameStop's total sales in the fourth quarter will most likely fall short in comparison to last year.

Yet, they also see hope in the fact that the other two hardware manufacturers – Microsoft and Sony – will release their next—generation consoles late in 2013.

The problem GameStop has, which has not changed over the past few years, is that they face two monumental shifts in consumer behavior. One is that games are increasingly accessed online, bypassing brick-and-mortar retailers altogether and thus fundamentally affecting boxed software sales. The other is the move away from traditional consoles sold by the likes of GameStop to tablets and mobile phones, which allow gaming digitally.

Software publishers, such as Electronic Arts and Activision, actively encourage both trends for several reasons. One is that games sold digitally directly to the consumers save them the 20% retailer margin they would normally have to pay the GameStops of this world. The second is that it is much more difficult to pirate digitally transmitted software. In fact, 20% of all boxed video games in circulation in the U.S. are pirated, which is a lot of business to lose. The third is that digital games cannot be resold as used games, which compete with new games and now represent about 15% of all the games sold in the United States.

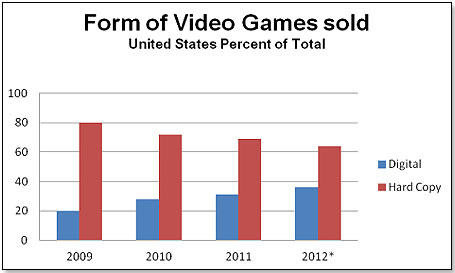

The move to digital games is real and accelerating:

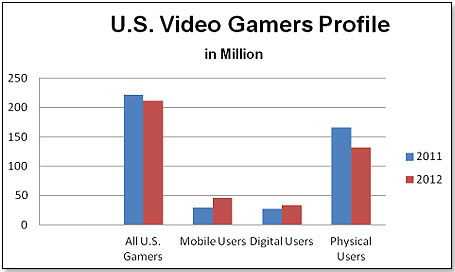

A similar shift is demonstrated by gamer profiles. According to NPD in their report dated September 5, 2012, this changed as follows:

The second major shift in consumer behavior – the one from consoles to mobile phones and tablets – is much more complex and much more insidious. Ironically, this shift has its roots in a decision taken by Nintendo seven years ago. The company had identified a consumer group that had been neglected by the then preeminent consoles – the Xbox and the PlayStation as well as Nintendo's own GameCube – and so they set out to tailor the Wii to capture and nurture it.

This consumer group was potentially receptive to games that were much less challenging and easier to play than the shooters that were then the core of the industry. Also, because they were not particularly interested in gaming in the first place, these consumers were much less willing to spend serious money. That meant a much lower selling price, which mandated less memory, a weaker processor, and weaker graphics.

On the positive side, the Wii had in the Wii Remote a much superior controller system. Its motion sensing capability allowed a much greater degree of physical, as opposed to intellectual, gaming exercises. And so, a new gaming genre was born.

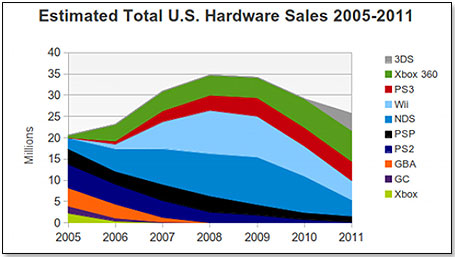

The Wii was launched late in 2006 and there is little doubt that the strategy worked. The Wii very quickly made inroads into consumer segments that had until then stayed away from gaming altogether. This is how sales developed in the console space between 2005 and 2011 according to Gamasutra's 1/17/2012 article "NPD: Behind the Numbers of 2011":

What this chart demonstrates very clearly is that the Wii, helped by the DS and lately by the 3DS, was the main driver during the video game expansion phase between 2006 and 2009. Nintendo's console sales have been in decline since then, and continue to decline into 2012 whilst the PS3 and Xbox 360 sales have held up pretty well.

What this chart does not show is the emergence of two very distinct consumer groups during the second half of the last decade – the hardcore versus the casual gamers.

Because the Wii was not really suitable for the more complex and technically challenging games that were until then the norm, the Publishers focused on the Xbox 360 and the PS3 as the consoles of choice for their "Teen" and "M" (mature)—rated games and basically saw the Wii – as well as the DS/3DS and the PSP — as the vehicle for their less challenging games under the ESRB ratings of "eC" (early Childhood), "E" (Everyone) and "E10" (Everyone 10+). In short, consumers playing "M" and "Teen"—rated games became identified as the Hardcore Group and all others as Casual Players.

My friends at GameStop and Micromania are all of the opinion that things began to turn negative for consoles, and particularly for the Wii, on the day the IPhone made its first appearance middle of 2007. Last year, the Casual Players group already represented 56% of the Gamers consumer group and this percentage is thought to have risen to 60% in 2012.

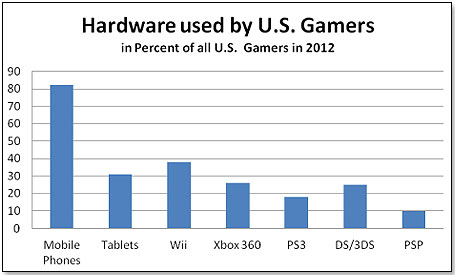

The use of the various hardware choices available to gamers shows a similar picture:

Nintendo is now faced with a problem of its own creation. The consumer group they identified, defined, and nurtured, has slowly assumed a life of its own and is beginning to move away from its creator. And there is little doubt that this trend will continue. The Wii U will not change it either. What is likely to happen in the twelve months after launch is that a very considerable number of current Wii users will upgrade to the Wii U. However, this will be a relatively short—lived phenomenon and the Wii U is expected to decline very sharply once this conversion phase has run its course.

And this means difficult times not only for Nintendo but also for GameStop, whose business is being eroded on all fronts: New Hardware and Accessories because of the move to other alternatives; New Software and Used Games because of the transition to the digital sphere.

This does not mean that the company will fall off a cliff. Their hardcore business will continue to thrive and will be enhanced by the introduction of next—gen consoles. Their new initiatives – selling used tablets, fostering digital sales, and opening kids—only stores during the Christmas period – will also have an effect. However, whether all this will be enough to preserve the company and their thousands of stores over the longer term is debatable.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • | • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|