|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

January 2021 | Vol. XX - No. 1

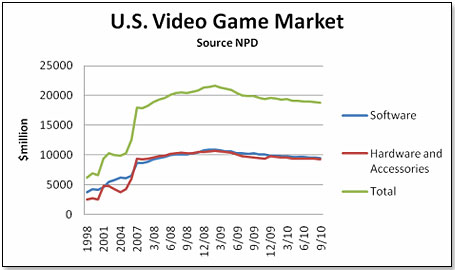

NPD does not measure two key components of the U.S. video game market – used games and digital sales. The former is important in that it represents a highly lucrative segment, one that basically keeps GameStop, the largest video-game only retailer in the United States, in business. The second is even more important, especially in the long run, as it represents the shape of the future. All indications are that future growth in video games will be driven by online. The national buyers I spoke to agree that all major segments of the video game marketplace will be affected by this to a major degree – from new hardware and accessories to all packaged software, whether new or pre-used. This is how the development is likely to play out:  There is a slight bump in the 2012 and 2013 time frame caused by the likely introduction of the next generation of consoles – the Xbox 720, the PS 4 and the WII U – and this in turn will in the same two years cause an uptick in software sales. However, as the chart above illustrates, the longer-term trend is very clear – down. The participants in this market place fall into two categories – those that will benefit from the trend and those that will go to the wall. The former are all those software publishers who manage to ride the digital tiger. The latter, the losers, are clearly the manufacturers of consoles – Microsoft, Nintendo and Sony - who have been locked out of the online MMORPG business all along and who will in all probability have equally no role to play in a universe dominated by online or cloud gaming.

OnLive Threatens Video Gaming As We Know ItNew and Used Video Game Markets Undergo Change in ‘09 After a stellar 2008, the video game market is entering choppy waters. January and February were still decent, according to the numbers, but the advent of OnLive and new entrants to the used-game space are likely to shake up sales in the near future. After a stellar 2008, the video game market is entering choppy waters. January and February were still decent, according to the numbers, but the advent of OnLive and new entrants to the used-game space are likely to shake up sales in the near future.Growth on the graph below is shown in percent moving annual totals. NPD data tells us that the Nintendo Wii continues on its upward, trend as does Microsoft’s Xbox 360 since it began turning around following the price cut. All other consoles are trending down. Both Amazon and Toys “R” Us are poised to enter the used-game market.

Amazon is offering to buy games at a price that is slightly better, on average, than what one would get from GameStop. However, Amazon will not take every game, and those they do take have to come in the original box with the instructions. According to my sources at GameStop, about 20 percent of the used games they receive lack these components. Individuals submitting games to Amazon must download the shipping label, drop the box into the post, and then wait about 10 days until they have their Amazon credit for the game. I, and most of my friends, think Amazon is unlikely to pose a major threat to GameStop because I do not know any serious gamer who is willing to wait that long. Amazon is offering to buy games at a price that is slightly better, on average, than what one would get from GameStop. However, Amazon will not take every game, and those they do take have to come in the original box with the instructions. According to my sources at GameStop, about 20 percent of the used games they receive lack these components. Individuals submitting games to Amazon must download the shipping label, drop the box into the post, and then wait about 10 days until they have their Amazon credit for the game. I, and most of my friends, think Amazon is unlikely to pose a major threat to GameStop because I do not know any serious gamer who is willing to wait that long.Toys “R” Us is a different kettle of fish. This third-largest retailer of new video games has, in each of its stores, a space and staff dedicated solely to video games. More importantly, they are absolutely committed to the venture. As one of my more senior friends at Toys “R” Us explained, “We took a leaf out of Wal-Mart’s strategy. They checkmated us about four years ago when they started to use toys in the fourth quarter as loss leader, knowing full well that we could not retaliate. If we do not make money on toys in the fourth quarter, we do not make money at all. We now use the same strategy towards GameStop. They cannot pay much more for the used games they buy, or go down too much with their used game prices because these margins represent half of their income. We, on the other side, can afford to pay higher prices and charge lower prices because, for us, this is a no-risk venture as long as we break even on the exercise.”  I believe Toys “R” Us is in the used-game business for keeps. I also believe, however, that there will be a cap to their inroads into GameStop’s business, for two reasons. First, GameStop has some 4,000 stores in the United States, and Toys “R” Us has a mere 700. It is more convenient to go to a GameStop than to a Toys “R” Us. I believe Toys “R” Us is in the used-game business for keeps. I also believe, however, that there will be a cap to their inroads into GameStop’s business, for two reasons. First, GameStop has some 4,000 stores in the United States, and Toys “R” Us has a mere 700. It is more convenient to go to a GameStop than to a Toys “R” Us.The second reason is that there is a social aspect to the GameStop store. The people behind the counter are much more embedded in the gaming communities in which they operate than their Toys “R” Us equivalents, which will make migration to Toys “R” Us somewhat slow. Also, at least at this point in time, the Toys "R" Us video game attendants are not as savvy or well informed as their GameStop counterparts. As an example, I asked both a GameStop store employee and a Toys “R” Us video game store supervisor as to what they knew about Toys “R” Us’s venture into used games. The GameStop employee knew all about it, while the Toys “R” Us employee had never heard of it.

GameStop – can they build a bridge before they hit the abyss?We all are familiar with the problems GameStop is facing. They are totally invested in brick-and-mortar at a time when consumer begin to buy more and more new games from the publishers directly online. In other words, the action is shifting away from GameStop and is going towards the publishers of games such as Activision and Electronic Arts. Equally importantly, they do not appear to have a strategy to turn this online threat to their advantage and perhaps there is indeed none to be had. GameStop's major money spinner is used games bought at their retail stores which are on a downwards slope given the fact that less and less new games are bought at retail which reduces the quantity of games that could be resold after use. There is another problem attached to this. A lot of old games are traded in for the newer ones and these old games just sit in inventory and cannot be resold – which leads to an increasing inventory overhang that will eventually force GameStop to take a severe haircut. We are already seeing this in their third quarter 2015 numbers which show that their inventory position increased from the 75.4 days a year earlier to now 84.7 days. Their second money spinner is new games which, as pointed above, are shifting away from them. This leaves new consoles, their least profitable money maker, and this category is again expected to decline given the rapidly increasing use of smart phones for gaming. And this is how GameStop's business segments developed worldwide to1/31/2016 [last quarter projected]:  Source SEC Filings In the most recent quarter, GameStop's U.S. sales were down by nearly 2% and operational earnings went down by 11%. In contrast, this is how the overall U.S. brick-and-mortar market developed over the years:  Source NPD

Old Games See New CompetitionUsed Video Game Market Doesn’t Stop at GameStopUpdate 7-2-09: Barry Judge, chief marketing officer of Best Buy, wrote in his blog June 23 that Best Buy is entering the used-games market with self-serve kiosks that scan customers' games and issue gift card vouchers. Some Best Buy stores in Austin and Dallas were testing the concept during the last week of June.

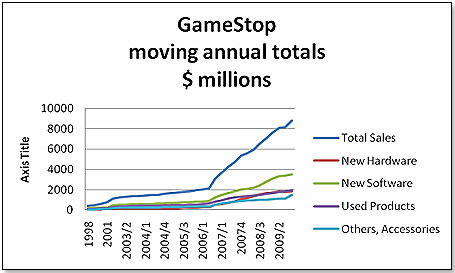

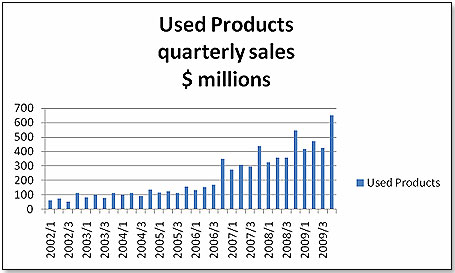

GameStop is the largest video game retailer in the world and used games make up nearly one quarter of their total sales:  This is how GameStop’s quarterly sales for used products have developed over the past seven years:  When looking at these graphs, remember that GameStop’s fiscal year ends in January. Hence, the first quarter of 2008 is in fact the three months of February to April. Interestingly, the largest video game retailer in Europe, Game Group, reports that 18 percent of its business is in used games, mainly in the UK. HOW DOES THIS USED-GAME BUSINESS WORK?  Assume you have a game that you played until you could do it in your sleep. Time to turn it in before boredom kills you. You take it to the nearest GameStop or Electronic Boutique (which is part of the GameStop group) and you tell the kid behind the counter, typically a male, that you would like to sell it. He will look at it and see whether it needs a lot of refurbishing. If necessary, the clerk will pop it into a console and check whether it works. If it does, he goes to the computer and checks with the corporate database to see the current price for this game if in mint condition. You can expect to get about half of the retail price of the used game. If the game or the box is not in immediately resalable condition, he deducts about a quarter from the price because he has to send it to a warehouse from where it is shipped to China for reconditioning. Whatever price you get, you get in the form of store credit. Assume you have a game that you played until you could do it in your sleep. Time to turn it in before boredom kills you. You take it to the nearest GameStop or Electronic Boutique (which is part of the GameStop group) and you tell the kid behind the counter, typically a male, that you would like to sell it. He will look at it and see whether it needs a lot of refurbishing. If necessary, the clerk will pop it into a console and check whether it works. If it does, he goes to the computer and checks with the corporate database to see the current price for this game if in mint condition. You can expect to get about half of the retail price of the used game. If the game or the box is not in immediately resalable condition, he deducts about a quarter from the price because he has to send it to a warehouse from where it is shipped to China for reconditioning. Whatever price you get, you get in the form of store credit.

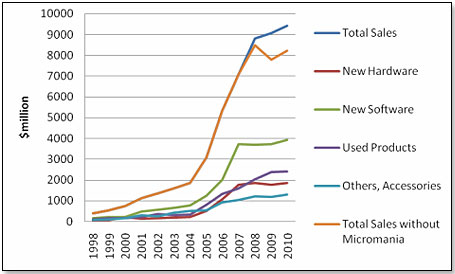

Quo Vadis GameStop?For many years, GameStop was the kingpin of the video game market. Not only were their stores the destination of choice for new consoles and games, they also were the place where gamers could buy and sell used games. In fact, GameStop had a virtual monopoly on this business and this showed in their profitability. On Consoles, they made less than 10%, on new games about 20% and on used games around 50%. They also benefited from the rapid growth the video game market enjoyed in the decade between 1998 and 2008. This growth was fuelled by the introduction of faster and better consoles that allowed gamers to play more and more challenging games. And so people bought more consoles and more games and where did they buy these? At GameStop, of course. There was a hiccup between 2001 and 2006 when the consumers knew that new consoles were on the way and held back from buying the old models. As soon as these arrived, the market took off like a rocket. We are now in the same part of the cycle. The consumers know that snazzy new consoles will come their way – with 3D, motion-sensors built in, sharper graphics and a few more bells and whistles – late 2012 or early 2013. In fact, as the chart below demonstrates, the consumers had begun to know about this as far back as January 2009.  In fact, GameStop’s business began to flatten out even earlier, in 2008.The reason for this is that a significant proportion of its consumers are very savvy hardcore gamers who, of course, would know well before anybody else that there were new consoles on the horizon. Management, well aware of these trends, sought to protect their flank by buying Micromania, France’s largest video game retailer, so as to ensure continued growth inspite of underlying trends:  Looking at stagnating sales should be bad enough but there are some more bad news for GameStop. And, as they say, bad news rarely come in singles. The first piece of really bad news was the ascent of the iPhone as a gaming platform. This is how the iPhone market share in the gaming space developed versus the two other handhelds – the DS and the PSP:

Gamestop – how long can they defy the odds?Gamestop has turned in another disappointing quarter and it behooves us to ask whether this is a short-term glitch or whether it is a signpost for things to come. Firstly, let us look at what GameStop’s business really is:  If you strip out all the hyperbole about growth and market shares, the facts are that Software, new and used, represented in the third quarter of 2014 more than 75% of the company’s sales and gross profit. Also, in an industry that moves more and more strongly into digital selling, GameStop’s brick-and-mortar sales still represent 95% of the total. Gamestop is the 800 lb gorilla in the video game space and is totally dependent on this space prospering. Their main market is the United States and we must hence take into account what happens there today. According to NPD, the gold standard in video game market research, the U.S. brick-and-mortar market has developed as shown in the graph below:  The New Software segment of the U.S. brick-and-mortar video game market has been declining every quarter since the end of 2008 but it still is Gamestop largest business and its second-largest gross profit generator (used games are their most profitable segment). All indications are that brick-and-mortar sales of video game products are going the way of the Neanderthals and that digital is taking over. This is the picture as reported by the leading video game publishers and compared to Gamestop’s:  The two leading U.S. publishers, Activision and Electronic Arts, are reporting digital sales either well above or only slightly below 50%. Gamestop, on the other hand, is still stuck below the 10% figure.

GameStop is Between a Rock and a Hard PlaceVideo game retail sales in the U.S. have been in the doldrums ever since they hit a high point back in 2009. However, this was then easily explained. Everybody was waiting for the new consoles to come out in 2012 and 2013 and did hence hold back on buying games for the older console versions. Things would turn sharply north once the eighth generation machines were becoming available. The first of them, the WII U, hit the market place in November 2012. While the machine initially flew off the shelves, software sales did not budge. In fact, they continued to drop. Again, this did not worry people because, after all, the real heavyweights – the Xbox One and the PS4 – were going to launch in November 2013 and this would trigger the long-awaited turnaround for video games. The two releases came and both consoles have since then broken all records. But software continued to slide consistently and the last reported month, June 2014, was no exception. This is how things developed:  The gurus who had been predicting a video game resurgence had, however, been right except it just did not happen in quite the way they had imagined. What occurred was that the same people who had bought the new consoles from the retailers also decided to go elsewhere for their video games – they went directly to the publishers from whom they could download the games. This trend had in fact started much earlier. The publishers – Activision and Electronic Arts in particular – had over the past seven or eight years made a consistent effort to shift consumer purchases away from retail to downloads, motivated by three factors. One was that they could pocket the retailer margin of about 20%. The second was that downloaded games are much more difficult to pirate – and pirating worldwide accounts for about 20% of all games sold at retail. The third was that downloaded games cannot, unlike boxed games, be resold as used games – and the publishers are completely excluded from the highly lucrative used game market dominated by GameStop. This is what in reality happened to video game sales in the U.S. according to the Klosters Retailer Panel and the national buyers:  In other words, the total U.S. video game market started to decline in 2010 and began to turn around again in 2012 – when the WII U launched. The rapid rise in downloads more than compensated for the decline in retail sales. This trend is expected to continue, not only in the United States but worldwide, and downloads are anticipated to represent more than three-quarters of all video game sales by 2020. This should not have come as a surprise to anybody who followed the two leading publishers – Electronic Arts and Activision. This is how their shipments went – boxed games sold at retail versus downloads:

GameStop better watch out – Galaxy 4 is coming to upset the video game applecartGalaxy 4 Game Pad Could Revolutionize the Video Game SpaceA few weeks ago, GameStop unveiled their 2012 results. The analysts attending the meeting were impressed by the very effective and highly polished presentation and the optimism and energy with which management painted the future of the company. GameStop shares have been on a tear ever since – up more than 23% in less than four weeks. I have said for months that GameStop’s situation is fraught, and recent developments tend to strengthen this conviction. Firstly, GameStop is a retailer pigeonholed into an industry category that is in transition, and this transition is away from retail. This is how the U.S. market, GameStop’s largest by far, has developed:   They outperformed the market itself by increasing market share – 38.2% at the end of 2011 to 47.1% in 2012. However, there is a point where market share increases become incrementally very expensive, and my friends at GameStop think that this point has pretty much been reached. There are a couple of forces that impact the video game market and spell potential disaster for GameStop. One is the move to digital downloads from consumers, which now represents 40% of all games sold. In contrast, GameStop’s digital sales only represented about 6% of their total video game sales in 2012. And this is not a one-day wonder. Electronic Arts’ COO predicted a few weeks ago that digitally delivered video games may account for 50 percent of sales by 2015 as more players migrate to tablets and smart phones from consoles. Unless GameStop manages to grab a much larger part of the digital market their sales will likely decline in line with the video game retail market. Secondly, parallel to the erosion of the boxed game business sold at retail you are seeing an erosion of the secondary market place, a trend that has been ongoing at GameStop since the fourth quarter of 2011. The less new games are bought at retail, the less used games will be available for trade-ins. Used games are GameStop’s cash cow with margins that are twice those for new games and, any negative sales developments will have a very major impact on GameStop’s bottom line.

GameStop is Riding the Digital TigerIn the Video Game Market, It's Eat or Be Eaten At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers. At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers.While all these factors are real, they do not necessarily spell the demise of GameStop today or tomorrow. Firstly, a look at the market place in the United States. The most important trend is that of skyrocketing online sales. There is no question that these are clearly the trend of the future. Six months ago, in this publication, I projected the overall video game sales curve forward to 2020 for both online sales and brick-and-mortar retail sales:  and added that  “The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.” “The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.”The latest NPD numbers confirm that this trend is well under way as far as brick-and-mortar sales of new video game products (except downloads and used games) are concerned:  Does this mean that GameStop can be counted out?. No, I do not think so. It is obvious, in retrospect, that they recognized nearly three years ago that the choice facing them was to either ride the digital tiger or be eaten by it. And not so surprisingly, they chose the former rather than the latter. They hence began to to embark upon a focused, logical, and well thought-out strategy to cope with the online challenge facing them. This is how the sequence of events unfolded:

In summary, GameStop first decided to create an instrument with which to execute the company’s digital strategy, staffed it with good and experienced people, and then made the acquisitions and implemented other initiatives to give muscle to the effort. However, the implementation still has ways to go if online activity is any guide (and given that we are discussing an online commercial strategy, online performance is probably the best of all yardsticks).

The Future of GamestopGameStop is struggling — and the Wii U can't save itThere is no question that GameStop has had a tough time of late. There are any number of reasons given – we are at the tail end of the last console cycle, there is a shift from consoles towards mobile phones and tablets, downloads are taking more and more share away from the brick—and—mortar retailers — but whatever the case may be, GameStop is struggling and the third quarter 2012 results just now published show no let-off in this pattern:  Also, the company's web traffic shows a similar picture and this in spite of their avowed determination to channel more business via their website:  Yet, not all is lost, at least for the fourth quarter. GameStop will have a couple of humongous releases – one is the Wii U, the second Halo 4 and the third CoD Black Ops 2. There has also been the release of Assassins Creed 3 on October 30th, which should contribute nicely during this quarter as well. All three titles promise to do extremely well and to significantly exceed the sales of their predecessors, which should provide a lift to GameStop's numbers. In addition, GameStop also benefits from the absolutely outstanding success of the Skylanders, particularly after the release of the Giants on October 21. I would expect this to result in yet another quarter where the Accessories sales exceed last year's numbers. However, the most important of releases this year is that of the Wii U, the first entrant in the new console cycle. Wii U will become available on Sunday, November 18, and is expected to sell 3.5 million units until end of the year – up from the 3.1 million units the Wii sold in 2006 when first released. GameStop is likely to move 450,000 units in the same time period, or about $150 million in sales. As a result, the company should for the first time in a long while show an up-tick in new hardware sale numbers. This will not change the fact that GameStop's total sales in the fourth quarter will most likely fall short in comparison to last year. Yet, they also see hope in the fact that the other two hardware manufacturers – Microsoft and Sony – will release their next—generation consoles late in 2013. The problem GameStop has, which has not changed over the past few years, is that they face two monumental shifts in consumer behavior. One is that games are increasingly accessed online, bypassing brick-and-mortar retailers altogether and thus fundamentally affecting boxed software sales. The other is the move away from traditional consoles sold by the likes of GameStop to tablets and mobile phones, which allow gaming digitally.  The move to digital games is real and accelerating:

Writer's Bio: A trilingual Translator & Interpreter who graduated from Notre Dame University in 2018, with a primary focus on various interdisciplinary practices. Stemming from my deep fondness for literature and psychology, my writing journey began 14 years ago and remains the beating heart at the very core of my career. Read more articles by this author

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||